Long term currency forecast with multiple trend corrected exponential smoothing with shifting lags

DOI:

https://doi.org/10.12928/ijio.v4i1.6972Keywords:

Time Series Analysis, Currency Forecasting, Exponential Smoothing, Trend correctionAbstract

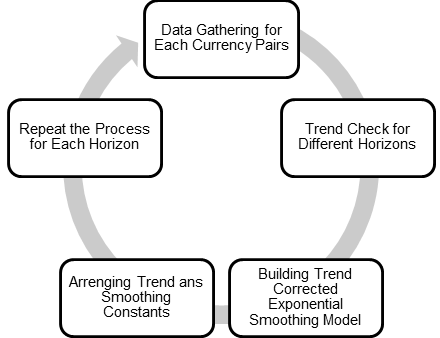

In the current global economy, exchange rate forecasting is critical for investors and businesses seeking to make informed investment decisions and manage risk. While many short-term exchange rate forecasting methods exist, long-term forecasting methods are limited and often fail to account for the complex macroeconomic factors that influence exchange rate trends. However, investors need to have an analytically examined basis for deciding to invest, which requires knowing more about the future values of the related market currency. This paper proposes a new Multiple Trend Corrected Exponential Smoothing with Shifting Lags model to forecast long-term exchange rates, which incorporates multiple trend corrections and shifting lags to provide more accurate predictions of future currency values. We apply the proposed method to six currency pairs (USD/EUR, USD/NOK, USD/TRY, USD/CNY, USD/XOF, and USD/MGF) from 2006 to 2018 and compare its performance to existing methods, such as moving average, weighted moving average, and exponential smoothing. Our results show that the proposed model provides more accurate long-term exchange rate forecasts for developed countries than existing methods. Our findings have important implications for investors and businesses seeking to manage currency risk and make informed investment decisions in the global economy.

References

J. Faust, J. H. Rogers, and J. H. Wright, "Exchange rate forecasting: the errors we've really made," Journal of International Economics, vol. 60, no. 1, pp. 35-59, May 2003.

F. C. Maria and D. Eva, "ExchangeRates Forecasting: Exponential smoothing techniques and ARIMA models," Annals of Faculty of Economics, vol. 1, no. 1, pp. 499-508, 2011.

L. Ghalayini, "Modeling and forecasting the US dollar/euro exchange rate," International Journal of Economics and Finance, vol. 6, no. 1, p. 194, January 2013.

N. Apergis, "Can gold prices forecast the Australian dollar movements?" International Review of Economics & Finance, vol. 29, pp. 75-82, September 2014.

J. Sun and H. Li, "Listed companies' financial distress prediction based on weighted majority voting combination of multiple classifiers," Expert System with Applications, vol. 35, pp. 818-827, September 2008.

J. Song, J. Wang, and H. Lu, "A novel combined model based on advanced optimization algorithm for short-term wind speed forecasting," Applied Energy, vol. 215, pp. 643-658, March 2018.

J. Taylor, "Short-term electricity demand forecasting using double seasonal," Tech. Rep., Center for Research in Econometric Analysis of Time Series (CREATES), Department of Economics and Business Economics, Aarhus University, Denmark, 2003.

J. Taylor, "Triple Seasonal Methods for Short-Term Electricity Demand Forecasting," European Journal of Operational Research, vol. 204, pp. 139-152, January 2010.

S. Widowati, S. Putro, V. Koshio, and V. Oktaferdian, "Implementation of ARIMA Model to Assess Seasonal Variability Macrobenthic Assemblages," Aquatic Procedia, vol. 7, pp. 277-284, August 2016.

P. Arumugam and R. Saranya, "Outlier Detection and Missing Value in Seasonal ARIMA Model Using Rainfall Data," Materials Today: Proceedings, vol. 5, pp. 1791-1799, January 2017.

R. MacDonald and M. Taylor, "The monetary approach to the exchange rate: rational expectations, long-run equilibrium, and forecasting," Palgrave Macmillan Journals, vol. 40, no. 1, pp. 23-38, March 1993.

S. Pong, M. Shackleton, S. Taylor, and X. Xu, "Forecasting currency volatility: A comparison of implied volatilities and AR(FI)MA models," Journal of Banking & Finance, vol. 28, pp. 2541-2563, November 2004.

S. Taylor, "Forecasting the volatility of currency exchange rates," International Journal of Forecasting, vol. 3, no. 1, pp. 159-170, March 1987.

A. Altan, S. Karasu, and S. Bekiros, "Digital currency forecasting with chaotic meta-heuristic bio-inspired signal processing techniques," Chaos, Solitons & Fractals, vol. 126, pp. 325-336, 2019.

A. A. Baffour, J. Feng, and E. K. Taylor, "A hybrid artificial neural network-GJR modeling approach to forecasting currency exchange rate volatility," Neurocomputing, vol. 365, pp. 285-301, 2019.

R. MacDonald and J. Nagayasu, "Currency forecast errors and carry trades at times of low interest rates: Evidence from survey data on the yen/dollar exchange rate," Journal of International Money and Finance, vol. 53, pp. 1-19, 2015.

M. E. Wilkie-Thomson, D. Önkal-Atay, and A. C. Pollock, "Currency forecasting: an investigation of extrapolative judgement," International Journal of Forecasting, vol. 13, no. 4, pp. 509-526, 1997.

P. bbassi and F. Bräuning, "Exchange rate risk, banks' currency mismatches, and credit supply," Journal of International Economics, vol. 141, art. no. 103725, 2023.

M. E. Wilkie and A. C. Pollock, "An application of probability judgement accuracy measures to currency forecasting," International Journal of Forecasting, vol. 12, no. 1, pp. 25-40, 1996.

L. T. Bui, V. T. Vu, and T. T. H. Dinh, "A novel evolutionary multi-objective ensemble learning approach for forecasting currency exchange rates," Data & Knowledge Engineering, vol. 114, pp. 40-66, 2018.

M. R. El Shazly and H. E. El Shazly, "Forecasting currency prices using a genetically evolved neural network architecture," International Review of Financial Analysis, vol. 8, no. 1, pp. 67-82, 1999.

T. T. L. Chong and I. K. Yan, "Forecasting currency crises with threshold models," International Economics, vol. 156, pp. 156-174, 2018.

S. R. Das, K. Kuhoo, D. Mishra, and M. Rout, "An optimized feature reduction-based currency forecasting model exploring the online sequential extreme learning machine and krill herd strategies," Physica A: Statistical Mechanics and its Applications, vol. 513, pp. 339-370, 2019.

M. Rout, B. Majhi, R. Majhi, and G. Panda, "Forecasting of currency exchange rates using an adaptive ARMA model with differential evolution based training," Journal of King Saud University - Computer and Information Sciences, vol. 26, no. 1, pp. 7-18, 2014.

S. Pong, M. B. Shackleton, S. J. Taylor, and X. Xu, "Forecasting currency volatility: A comparison of implied volatilities and AR(FI)MA models," Journal of Banking & Finance, vol. 28, no. 10, pp. 2541-2563, 2004.

J. Mehran and M. Shahrokhi, "An application of four foreign currency forecasting models to the U.S. dollar and Mexican peso," Global Finance Journal, vol. 8, no. 2, pp. 211-220, 1997.

M. D. Chinn and R. A. Meese, "Banking on currency forecasts: How predictable is change in money?," Journal of International Economics, vol. 38, no. 1-2, pp. 161-178, 1995.

G. Bekaert and R. Hodrick, International Financial Management, 3rd ed. Cambridge: Cambridge University Press, 2017, ch. 10, pp. 394-442.

J. Crespo Cuaresma, I. Fortin, and J. Hlouskova, "Exchange rate forecasting and the performance of currency portfolios," Journal of Forecasting, vol. 37, pp. 519-540, 2018.

A. Suharsono, Suhartono, A. Masyitha, and A. Anuravega, "Time series regression and ARIMAX for forecasting currency flow at Bank Indonesia in Sulawesi region," in AIP Conference Proceedings, vol. 1691, 050025, 2015.

A. Inoue and B. Rossi, "Monitoring and forecasting currency crises," Journal of Money, Credit and Banking, vol. 40, pp. 523-534, 2008.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Muhammed Sutcu, Ibrahim Tumay Gulbahar

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

License and Copyright Agreement

In submitting the manuscript to the journal, the authors certify that:

- They are authorized by their co-authors to enter into these arrangements.

- The work described has not been formally published before, except in the form of an abstract or as part of a published lecture, review, thesis, or overlay journal. Please also carefully read the International Journal of Industrial Optimization (IJIO) Author Guidelines at http://journal2.uad.ac.id/index.php/ijio/about/submissions#onlineSubmissions

- That it is not under consideration for publication elsewhere,

- That its publication has been approved by all the author(s) and by the responsible authorities tacitly or explicitly of the institutes where the work has been carried out.

- They secure the right to reproduce any material that has already been published or copyrighted elsewhere.

- They agree to the following license and copyright agreement.

Copyright

Authors who publish with the International Journal of Industrial Optimization (IJIO) agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License (CC BY-SA 4.0) that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.

1.png)