Millennial Generation (Gen-Y) Preferences Towards Landed House Ownership in Yogyakarta Urban Agglomeration Using Logistic Regression

DOI:

https://doi.org/10.12928/jampe.v3i1.9078Keywords:

Agglomeration, Landed House Logistic, Millennial Generation, Regression, Yogyakarta UrbanAbstract

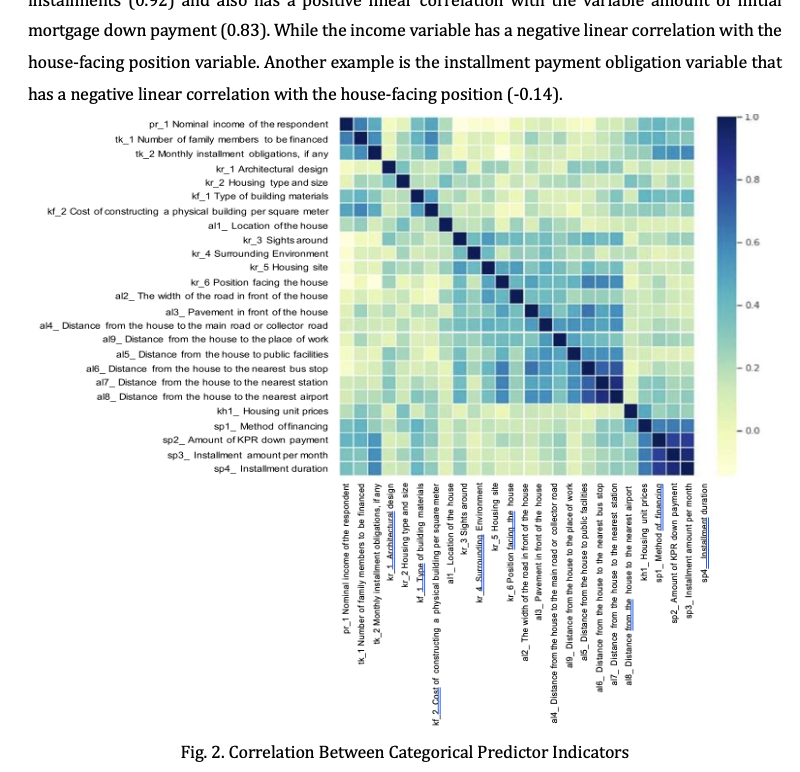

The city of Yogyakarta has become a magnet for the millennial generation (Gen-Y), leading to increased urbanization as residents flock to the city. This surge has resulted in a growing demand for land to accommodate public facilities, social amenities, and housing for workers. Despite soaring land prices, driven by high demand, land stocks have not diminished. Over the last 16 years, land prices have escalated by 30 times. However, the wages of Gen-Y formal workers in the DIY region stand at IDR 2,361,434, with an annual increase of only 8.51%. This rapid growth in property prices has not kept pace with the income growth of the millennial generation, raising concerns about their ability to access landed house ownership. This study aims to identify the preferences of the millennial generation regarding landed house ownership in the Yogyakarta Urban Agglomeration. The analytical method employed is Logistic Regression, involving 125 respondents of Gen-Y workers aged 27 to 41 years in the Yogyakarta Urban Agglomeration. Seven variables, encompassing 25 categorical predictors, were considered. The significant indicators influencing Gen-Y preferences in landed house ownership include the cost of building a house, building materials, and the nominal installment of the house. The findings of this research can be instrumental for relevant stakeholders in formulating policies in the housing sector, particularly in the regulation of subsidized housing for the Gen-Y. The contribution of this study lies in providing essential information for informed decision-making and effective policy implementation to tackle the housing challenges faced by the millennial generation in the Yogyakarta Urban Agglomeration.

References

Bank Indonesia (2023). Report Property Price Survey residential. https://www.bi.go.id/id/publikasi/report/Documents/SHPR-Tw.I-2023.pdf, accessed on 16 July 2023

Bateman, I. J. (2009). Bringing the real world into economic analyses of land use value: Incorporating spatial complexity. Land Use Policy, 26S, S30-S42. https://doi.org/10.1016/j.landusepol.2009.09.010

Burriel, E. L. (2016). Empty urbanism: the bursting of the Spanish housing bubble. Urban Research & Practice, 9 (2), 158-180. https://doi.org/10.1080/17535069.2015.1110196

Central Bureau of Statistics (2023). Percentage Urban Area Residents according to Province, 2010-2035.https://www.bps.go.id/statictable/2014/02/18/1276/persentase-penjuang-area-perkotaan-menurut-provinsi-2010-2035.html, accessed on 15 July 2023.

Dubéa, J., & Legros, D. (2014). Spatial econometrics and the hedonic pricing model: what about the temporal dimension? Journal of Property Research, 31 (4), 333-359. https://doi.org/10.1080/09599916.2014.913655

Egner, B., & Grabietz, K. J. In search of determinants for quoted housing rents: Empirical evidence from major German cities. Urban Research & Practice, 11 (4), 460-477

Fang, C., & Yu, D. (2017). Urban Agglomeration: an evolving concept of an emerging phenomenon.

Landscape and Urban Planning, 162, 126-136. https://doi.org/10.1016/j.landurbplan.2017.02.014

Gottlieb, P. D. (2009). The impact of down-zoning land values: A theoretical approach. Agricultural Finance Review, 69 (2), 206-227. https://doi.org/10.1177/0042098017736426

Grobel, S. (2019). Analysis of spatial variance clustering in the hedonic modeling of housing prices. Journal of Property Research, 36 (1), 1-26. https://doi.org/10.1080/09599916.2018.1562490

Haque, I., Rana, M. J., & Patel, P. P. (2020). Location matters: Unravelling the spatial dimensions of neighborhood level housing quality in Kolkata, India. Habitat International , 99, 102-127. https://doi.org/10.1016/j.habitatint.2020.102157

Haque, I., & Patel, P. P. (2018). Growth of metro cities in India: trends, patterns and determinants.

Urban Research & Practice, 11 (4), 338-377. https://doi.org/10.1080/17535069.2017.1344727

Hin Li, L. (2009). Land price changes in the evolving land market in Beijing. Property Management, 27 (2), 91-108. DOI: 10.1108/02637470910946408

Kaya, S. K., Ozdemir, Y., & Dal, M. (2019). Home-buying behavior model of Generation Y in Turkey. International Journal of Housing Markets and Analysis, 13 (5), 713-736. https://doi.org/10.1108/IJHMA-05-2019-0048

Khoirudin, R. Vebriana, L., Abdulkarim, F.M. (2022). Analysis of Optimization of Fixed Asset Management for Sleman Regency Government. Journal of Asset Management and Public Economy 1(1), 1-8. https://doi.org/10.12928/jampe.v1i1.4952

Lee, Y., Circella, G., Mokhtarian, P. L., & Guhathakurt, S. (2019). Heterogeneous residential preferences among millennials and members of generation X in California: A latent-class approach. Transportation Research Part D, 76, 289-304. https://doi.org/10.1016/j.trd.2019.08.001

Lerbs, O. W. (2014). House prices, housing development costs, and the supply of new single-family housing in German counties and cities. Journal of Property Research, 31 (3), 183-210. https://doi.org/10.1080/09599916.2014.893249

Liang, X., Liu, Y., Qiu, T., Jing, Y., & Fang, F. (2018). The effects of locational factors on the housing prices of residential communities: The case of Ningbo, China. Habitat International, 81, 1-11. https://doi.org/10.1016/j.habitatint.2018.09.004

Lyons, R. C. (2015). East, west, boom and bust: the spread of house prices and rents in Ireland, 2007–2012. Journal of Property Research, 32 (1), 77-101. DOI: 10.1080/09599916.2013.870922

Meulen, P. a., Micheli, M., & Schmidt, T. (2014). Forecasting real estate prices in Germany: the role of consumer confidence. Journal of Property Research, 31 (3), 244-263. DOI: 10.1080/09599916.2014.940059

Meyfroidt, A. (2017). Non-profit housing, a tool for metropolitan cohesion? The case of the Vienna- Bratislava region. Urban Research & Practice, 10 (4), 442-465. https://doi.org/10.1080/17535069.2016.1253111

Nase, I., Berryb, J., & Adair, A. (2016). Impact of quality-led design on real estate value: a spatiotemporal analysis of city centre apartments. Journal of Property Research, 33 (4), 309- 331. https://doi.org/10.1080/09599916.2016.1258588

Rahadi, R. A., Wiryono, S. K., Koesrindartoto, D. P., & Syamwil, I. B. (2015). Comparison of the property practitioners and consumer preferences on housing prices in the Jakarta metropolitan region. International Journal of Housing Markets and Analysis, 8 (3), 335- 358. DOI: 10.1108/IJHMA-10-2014-0043

Rahadi, R. A., Wiryono, S. K., Koesrindartoto, D. P., & Syamwil, I. B. Factors influencing the price of housing in Indonesia. International Journal of Housing Markets and Analysis, 8 (2), 169-188. DOI: 10.1108/IJHMA-04-2014-0008

Rave, J., Morales, J., & Echavarría, F. (2019). A machine learning approach to big data regression analysis of real estate prices for inferential and predictive purposes. Journal of Property Research, 36 (1), 59-96. https://doi.org/10.1080/09599916.2019.1587489

Schulza, R., Wersinga, M., & Werwatz, A. (2014). Automated valuation modelling: a specification exercise. Journal of Property Research, 31 (2), 131-153. DOI: 10.1080/09599916.2013.846930

Sotoca, A. (2016). Urban growth management in Catalonia, 2005-2010. Urban Research & Practice, 9 (1), 91-102. https://doi.org/10.1080/17535069.2016.1138685

Tripathi, S., & Mahey, K. (2017). Urbanization and economic growth in Punjab (India): an empirical analysis. Urban Research & Practice, 10 (4), 379-402. DOI: 10.1080/17535069.2016.1227875

Yi, R., & Li, M. (2015). Generation X and Y’s demand for homeownership in Hong Kong. Pasific Rim Property Research Journal, 21 (1), 15-36. DOI: 10.1080/14445921.2015.1026195.

Yunus, N. (2016). Modelling interactions among the housing market and key US sectors. Journal of Property Research, 33 (2), 121-146.

Downloads

Published

Issue

Section

License

Copyright (c) 2024 Fatima Putri Prativi, Nur Aini Yuniarti, Ibrahin Sorie Kamara

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.