Abusers of Land Value Zone Utilization: Study of Special Funds and D.I.Yogyakarta Tourist Visitors

DOI:

https://doi.org/10.12928/jampe.v3i1.8969Keywords:

Land Value Zone, Panel Data Regression, Special Funds, Tourist VisitsAbstract

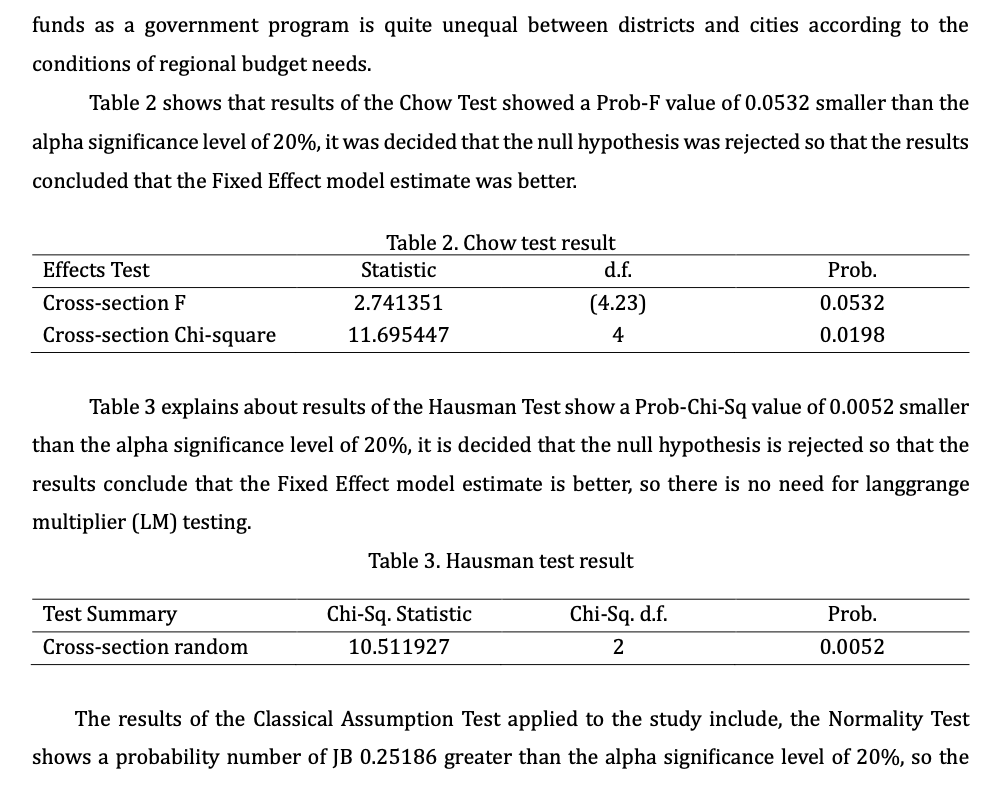

The purpose of this research is to identify the effect of special funds and tourist visits on the number of tours in land value zones in D.I. Yogyakarta Province. The research adopts a panel data approach, utilizing secondary data from government agencies in the research location. Data collection employs a non-probability purposive sampling model, incorporating a total of 30 observational data points representing 5 districts and cities in D.I. Yogyakarta Province. Data analysis is conducted through panel data regression using the Eviews 12 SV analysis tool. The results of this research indicate that the best model chosen is the fixed effect model. The research data statistically confirm the normal distribution of data observations. Specifically, the findings reveal that the number of tourist visits has a significant and positive effect on land value zones in D.I. Yogyakarta Province. However, the variable of special funds does not exhibit any significant effect on these zones. The contribution of this study is in providing insights into the factors influencing land value zones in the province, particularly the noteworthy positive impact of tourist visits. This understanding can be valuable for policymakers and stakeholders in formulating strategies to enhance land value and promote sustainable tourism development in the region.

References

Abay, K. A., Chamberlin, J., & Berhane, G. (2021). Are land rental markets responding to rising population pressures and land scarcity in sub-Saharan Africa? Land Use Policy, 101(October 2020), 105139. https://doi.org/10.1016/j.landusepol.2020.105139

Adamie, B. A. (2021). Land property rights and household take-up of development programs: Evidence from land certification program in Ethiopia. World Development, 147, 105626. https://doi.org/10.1016/j.worlddev.2021.105626

Baltagi, B. H. (2021). Econometric Analysis of Panel Data (Springer Texts in Business and Economics) - Sixth Edition. In Springer.

Buitrago-Mora, D., & Garcia-López, M. À. (2023). Real estate prices and land use regulations: Evidence from the Law of Heights in Bogotá. Regional Science and Urban Economics, 101(April), 103914. https://doi.org/10.1016/j.regsciurbeco.2023.103914

Cai, W., & Fangyuan, T. (2020). Spatiotemporal characteristics and driving forces of construction land expansion in Yangtze River economic belt, China. PLoS ONE, 15(1), 1–20. https://doi.org/10.1371/journal.pone.0227299

de Zwart, P., & Soekhradj, P. (2023). Sweet equality: Sugar, property rights, and land distribution in colonial Java. Explorations in Economic History, 88(April 2022), 101513. https://doi.org/10.1016/j.eeh.2023.101513

Filippelli, R., Termansen, M., Hasan, S., Hasler, B., Hansen, L., & Smart, J. C. R. (2022). Water quality trading markets – Integrating land and marine based measures under a smart market approach. Ecological Economics, 200(July), 107549. https://doi.org/10.1016/j.ecolecon.2022.107549

Firmansa, F. A., Anggraeny, I., & Pramithasari, Y. P. (2020). Legal Review of Selling Land of Inheritance without Approval of All Heirs. Legality: Jurnal Ilmiah Hukum, 28(1), 107–120. https://doi.org/10.22219/ljih.v28i1.11817

H. Grubbe, F., Shea-Joyce, S., & Chitester, K. (2014). The Appraisal of Real Estate (M. McKinley & E. Ruzich (eds.); Fourtheent). Appraisal Institute Press.

Khoirudin, R., Wahyuni, S., & Nugraha, C. B. (2021). Distribution of Optimized Public Assets Utilization in Yogyakarta Province. Jurnal Analisis Bisnis Ekonomi, 19(1), 48-62. doi:https://doi.org/10.31603/bisnisekonomi.v19i1.3757

Khoirudin., R., Vebriana, L., & Abdulkarim, F. M. (2021). Analysis of Optimization of Fixed Asset Management for Sleman Regency Government. Journal of Asset Management and Public Economy, 1(1), 1-8. doi:https://doi.org/10.12928/jampe.v1i1.4952

Larson, W. D., & Shui, J. (2022). Land valuation using public records and kriging: Implications for land versus property taxation in cities. Journal of Housing Economics, 58(PA), 101871. https://doi.org/10.1016/j.jhe.2022.101871

Lazoglou, M., & Angelides, D. C. (2020). Development of a spatial decision support system for land-use suitability assessment: The case of complex tourism accommodation in Greece. Research in Globalization, 2, 100022. https://doi.org/10.1016/j.resglo.2020.100022

McDonald, P. (2023). Locational and market value of Renewable Energy Zones in Queensland. Economic Analysis and Policy, 80, 198–213. https://doi.org/10.1016/j.eap.2023.08.008

Nasir, Z. A., Nurpita, A., & Nugraheni, A. I. (2023). Utilizing Ex-Bird Market Buildings in the City of Balikpapan: Needs and Economics Approach Analysis. Journal of Asset Management and Public Economy, 2(2), 119-132. doi:https://doi.org/10.12928/jampe.v2i2.7773

Renigier-Biłozor, M., Źróbek, S., Walacik, M., & Janowski, A. (2020). Hybridization of valuation procedures as a medicine supporting the real estate market and sustainable land use development during the covid-19 pandemic and afterwards. Land Use Policy, 99(November). https://doi.org/10.1016/j.landusepol.2020.105070

Ryan, T. P. (2013). Sample Size Determination and Power. In Sample Size Determination and Power. https://doi.org/10.1002/9781118439241

Saleh, R. (2022). Kajian determinan nilai properti perumahan (studi pada lampung selatan: kecamatan natar dan tanjung bintang). Manajemen Aset Dan Penilaian, 2(2), 92–98. https://doi.org/10.56960/jmap.v2i2.43

Scheyvens, R., Banks, G., Vunibola, S., Steven, H., & Meo-Sewabu, L. (2020). Business serves society: Successful locally-driven development on customary land in the South Pacific. Geoforum, 112(March), 52–62. https://doi.org/10.1016/j.geoforum.2020.03.012

Sodiya, A. K., Ibisola, A. S., & Fateye, T. B. (2021). Impact of cemetery on proximate residential property value. Ethiopian Journal of Environmental Studies & Management, 14(1), 1–11. https://doi: https://ejesm.org/doi/v14i1.

Tione, S. E., & Holden, S. T. (2020). Urban proximity, demand for land and land shadow prices in Malawi. Land Use Policy, 94(February), 104509. https://doi.org/10.1016/j.landusepol.2020.104509

Walacik, M., Renigier-Biłozor, M., Chmielewska, A., & Janowski, A. (2020). Property sustainable value versus highest and best use analyzes. Sustainable Development, 28(6), 1755–1772. https://doi.org/10.1002/sd.2122

Wooldridge, J. M. (2015). Introductory Econometrics 6th Edition. In Economica (Vol. 42, Issue 165).

Zhang, J., Li, L., Yu, T., Gu, J., & Wen, H. (2021). Land assets, urban investment bonds, and local governments’ debt risk, china. International Journal of Strategic Property Management, 25(1), 65–75. https://doi.org/10.3846/ijspm.2020.13834

Downloads

Published

Issue

Section

License

Copyright (c) 2024 Leng Davy, Rahmat Saleh

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.