Structural Decomposition of Residential Property Prices in Indonesia: a VAR Approach

DOI:

https://doi.org/10.12928/jampe.v2i1.6937Keywords:

Property Prices , Structural Decomposition, VARAbstract

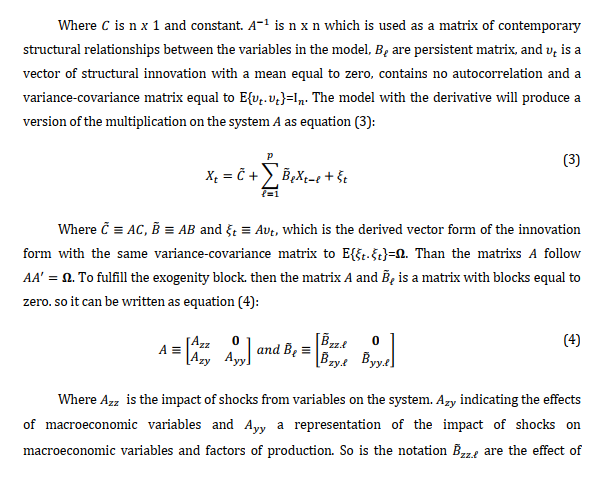

Home ownership is so important for human survival. the Residential Property Price Index or IHPR increases every time. It is feared that the continuous increase in house prices exceeding their fundamental value will lead to a property bubble like the one that hit the United States in 2008. This study contributes to look at the IHPR's response to shocks from inflation. BI interest rate, GDP, compensation index for permanent workers and Construction Daily Worker and Construction IHPB. Using time-series data from 2010Q1-2021Q4 and the VAR method shows that the IHPR responds positively to changes in the shock of the inflation variable, the compensation index for permanent workers and construction daily workers and the WPI for Construction. Meanwhile, the IHPR response negatively to changes in interest rates and GDP. Based on the results of the variance decomposition. the construction IHPB is the variable that contributes the most. namely 12.2% to changes in IHPR. Implication of the research to maintain the macroeconomic condition to courage the IHPR on stabil condition.

References

Algieri. B. (2013). House Price Determinants: Fundamentals and Underlying Factors. Comparative Economic Studies. 315-341. https://doi.org/10.1057/ces.2013.3

Alkali. M. A.. Sipan. I.. & Razali. M. N. (2019). An Overview of Macro-Economic Determinants of Real Estate Price in NIgeria. International Journal of Engineering & Technology. 484-488. https://doi.org/10.14419/ijet.v7i3.30.18416

Anastasia. N.. & Hidayat. f. (2017). Hubungan Indeks Harga Properti Residensial. PDB. Suku Bunga KPR dan Kredit Perbankan. Ekuitas: Jurnal Ekonomi dan Keuangan. 95-111. https://doi.org/10.24034/j25485024.y2019.v3.i1.3998

Ascarya. (2012). Transmission Channel and Effectiveness of Dual Monetary Policy in Indonesia. Buletin of Monetary Economics and Banking. 270-298. https://doi.org/10.21098/bemp.v14i3.405

Basuki. T. A.. & Prawoto. N. (2017). Analisis Regresi Dalam Penelitian Ekonomi dan Bisnis. Depok: PT Rajagrafindo Persada.

Ben S. Bernanke & Kenneth N. Kuttner, 2005. What Explains the Stock Market's Reaction to Federal Reserve Policy?, Journal of Finance, American Finance Association, Vol. 60 (3), pp. 1221-1257. https://doi.org/10.1111/j.1540-6261.2005.00760.x

Bilozor, Malgorzata Renigier and Wiśniewski, Radosław. (2012). The Impact of Macroeconomic Factors on Residential Property Price Indices in Europe. Folia Oeconomica Stetinensia, Vol. 12 No.2. https://doi.org/10.2478/v10031-012-0036-3

(PDF) The Impact of Macroeconomic Factors on Residential Property Price Indices in Europe. Available from: https://www.researchgate.net/publication/272667303_The_Impact_of_Macroeconomic_Factors_on_Residential_Property_Price_Indices_in_Europe [accessed Jan 28 2023].

Borowiecki. K. J. (2016). The Determinant of House Price and Construction: An Empirical Investigation of the Swiss Housing Economy. International Real Estate Review, 193-220. https://doi.org/10.53383/100112

BPS. (2022. January 21). Retrieved from Badan Pusat Statistik: https://www.bps.go.id/subject/19/upah-buruh.html

Chen. R.. Christoper. G.. Hu. B.. & Cohen. D. (2013). An Emprirical Analysis of House Price Bubble: A Case Study of Beijing Housing Market. Research in Applied Economicsc. https://doi.org/10.5296/rae.v5i1.3433

Cohen. V.. & Karpaviciute. L. (2017). The Analysis of the Determinants of Housing Price. Independent Journal of Management & Production. 49-63. https://doi.org/10.14807/ijmp.v8i1.521

Fanama. V.. & Praktiko. R. (2019). Bubble Property di Indonesia: Analisis Empiris Survei Harga Properti Residensial. Jurnal Administrasi Bisnis. 169-180.

Fauzia. L. R. (2019). Determinan Harga Rumah di Indonesia. Jurnal Ekonomi Pembangunan. 61-68.

G.A. Diah Utari. R. C. (2015). Inflasi di Indonesia: Karakteristik dan Pengendaliannya. Bank Indonesia Institute.

Ge. X. J.. & Williams. B. (2015). House Price Determinants in Sydney. ERES. 135-148. https://doi.org/10.15396/eres2015_230

Gujarati. (2004). Basic Econometrics. 4th Edition. McGraw-Hill Companies.

Gujarati. D. (1995). Dasar-Dasar Ekonometrika. In A. B. Zain. Jakarta: Erlangga.

Hafly. M. I. (2016). Analisis Dana Pihak Ketiga (DPK). Sertifikat Bank Indonesai Syariah (SBIS). dan Non Performing Finance (NPF) Terhadap Pembiayaan Pada Bank Syariah Di Indonesia. 57-66.

Iacoviello, Matteo, and Stefano Neri. (2010). Housing Market Spillovers: Evidence from an Estimated DSGE Model. American Economic Journal: Macroeconomics, Vol. 2 No.2, pp. 125-64. DOI: 10.1257/mac.2.2.125. https://doi.org/10.1257/mac.2.2.125

Kurniawan, Mahrus Lutfi Adi and A’yun, Indanazulfa Q. (2022). Dynamic Analysis On Export, FDI and Growth in Indonesia: An Autoregressive Distributed Lag (ARDL) Model. Journal of Economics, Business, & Accountancy Ventura, Vol. 24 No.3 pp. 350-362. https://doi.org/10.14414/jebav.v24i3.2717

Mishkin, F.S, 2007. The Economics of Money, Banking and Financial Markets. Seventh Edition. International Edition, New York: Pearson Addison.

Ruiz, Isabel and Carlos Vargas, Silva. (2018). Differences in labour market outcomes between natives, refugees and other migrants in the UK. Journal of Economic Geography, Vol. 18, No. 4, July 2018, pp. 855–885, https://doi.org/10.1093/jeg/lby027.

Downloads

Published

Issue

Section

License

Copyright (c) 2023 Naveed Aslam, Mahrus Lutfi Adi Kurniawan, Wisnu Hammam Pratama

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.