Analysis of Oil and Gas Exports Imports on the Indonesian Rupiah Exchange Rate in 1980-2020

DOI:

https://doi.org/10.12928/jampe.v2i1.6492Keywords:

Economic growth , Exchange rate, Exports , ImportsAbstract

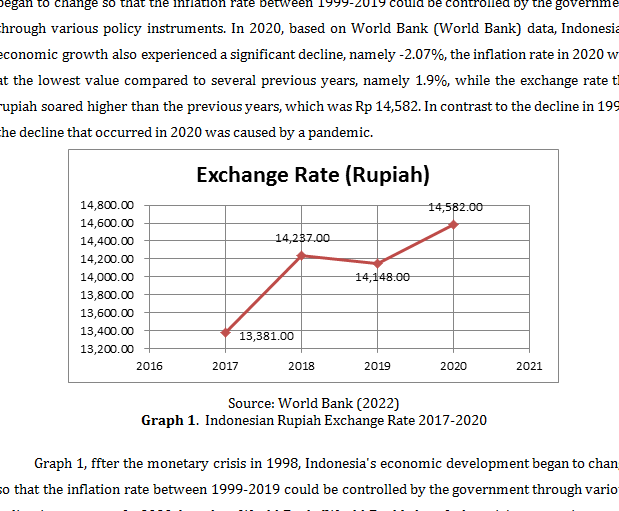

International trade is important activities for the economy. The advantages and benefits in international trade that can be obtained by a country is that it allows the opportunity to specialize in obtaining goods and services at lower prices. Therefore, the contribution of this study is to analyze exports, imports, inflation, and economic growth against the Indonesian rupiah exchange rate. The dependent variable used is the rupiah exchange rate variable, and the independent variables include oil and gas exports, oil and gas imports, inflation, and economic growth. Data that used is secondary data obtained through the official website of the World Bank, and the Central Statistics Agency (BPS). The method used is the Multiple Linear Regression model. Based on the results of the regression calculations show that the variable oil and gas exports have no significant effect, oil and gas imports have a positive and significant, inflation has no significant effect, and economic growth negative and significant effect on the rupiah exchange rate.

References

Afriyanti, N., & Prasetiyo, L. (2021). Pengaruh Inflasi dan Pertumbuhan Ekonomi Terhadap Nilai Tukar Rupiah dalam Jangka Pendek dan Jangka Panjang Tahun 2010-2018. Journal of Islamic Economics, 1(1). https://doi.org/10.21154/joie.v1i1.3081

Bato, A. R., Taufiq, M., & Putri, E. R. (2017). Analisis Pengaruh Variabel Makro Ekonomi Terhadap Nilai Tukar Rupiah Tahun 2006-2015. Laa Maisyir: Jurnal Ekonomi Islam, 4(2), 74–95. https://doi.org/10.20473/vol4iss20177pp587-598

Djulius, H., & Nurdiansyah, Y. (2014). Keseimbangan Jangka Pendek dan Jangka Panjang Nilai Tukar Rupiah terhadap Dollar Amerika. Jurnal Ekonomi Trikononomika, 13(No 12), 13–20. https://doi.org/10.23969/trikonomika.v13i1.482

Dzakiyah, Z., Puspitaningtyas, Z., & Puspita, Y. (2018). Pengaruh Jumlah Nilai Ekspor Dan Tingkat Inflasi Terhadap Kurs Rupiah Tahun 2009-2016. Jurnal Perilaku Dan Strategi Bisnis, 6(2), 103. https://doi.org/10.26486/jpsb.v6i2.559

Falianty, T. A. (2015). Penurunan Harga Minyak Mentah Internasional: Menguntungkan atau Merugikan? Program Studi Magister Perencanaan Ekonomi Dan Kebijakan Pembangunan. https://mpkp.feb.ui.ac.id/penurunan-harga-minyak-mentah-internasional-menguntungkan-atau-merugikan/

Felinda, H., & Mindosa, B. (2020). CADANGAN DEVISA TERHADAP NILAI TUKAR RUPIAH TERHADAP DOLLAR AMERIKA SERIKAT PERIODE 2016-2018. Institut Bisnis Dan Informatika Kwik Kian Gie, 1–14.

Fordatkosu, S., Joan Kumaat, R., & Mandeij, D. (2021). Analisis Pengaruh Ekspor Impor dan Jumlah Uang Beredar (M2) di Indonesia Terhadap Nilai Tukar Rupiah / US$ Dollar (2000-2019). 21(06), 82–91.

Hazizah, N., Zainuri, & Viphindrartin, S. (2017). Pengaruh JUB , Suku Bunga , Inflasi , Ekspor dan Impor terhadap Nilai Tukar Rupiah atas Dollar Amerika Serikat. IV(2000), 97–103. https://doi.org/10.19184/ejeba.v4i1.4600

Istiqamah, & Septiana, H. A. (2018). Pengaruh Inflasi dan Suku Bunga terhadap Nilai Tukar Rupiah pada Dollar Amerika. Jurnal Spread, 8(1), 19–30.

Mardiana, R., & Lenysuzan. (2016). Pengaruh Timhkat Inflasi dan Pertumbuhan Ekonomi Terhadap Nilai Tukar Rupiah. 3(2), 1691–1698. https://doi.org/10.15408/sjie.v2i1.2373

Musa, Y., & Sanusi, J. (2013). Industrial Output Response to Inflation and Exchange Rate in Negeria. Journal of Economics Sustainable Development, 4(20), 74–81.

Ningsih, A. W. (2021). Pergerakan Nilai Tukar Rupiah ( Terhadap Dolar Amerika ) Pada Sistem Mengambang Bebas di Indonesia. 1, 195–202.

Nopirin. (1987). Ekonomi Moneter (Pertama). BPFE-Yogyakarta.

Pershin, V., Molero, J. C., and de Garcia, F. P. (2016). Exploring the Oil Prices and Exchange Rates Nexus in Some African Economies. Journal of Policy Modeling, 38, 166-180. https://doi.org/10.1016/j.jpolmod.2015.11.001

Puspitaningrum, R., Suhadak, & Z.A, Z. (2014). Pengaruh Tingkat Inflasi, Tingkat Suku Bunga SBI, dan Pertumbuhan Ekonomi Terhadap Nilai Tukar Rupiah. Jurnal Administrai Bisnis, 8(13190276), 1.

Queye, A.B., Mignon, V., and Penot, A. (2007). China and the Relationship between Oil Price and the Dollar. Energy Policy , 35, 5795-5806. https://doi.org/10.1016/j.enpol.2007.05.035

Safitriani, S. (2014). Perdagangan Internasional Dan Foreign Direct Investment Di Indonesia. Buletin Ilmiah Litbang Perdagangan, 8(1), 93–116. https://doi.org/10.30908/bilp.v8i1.89

Silitonga, R. B. R., & Ishak, Z. (2017). Pengaruh ekspor , impor , dan inflasi terhadap nilai tukar rupiah di Indonesia. Jurnal Ekonomi Pembangunan, 15(1), 53–59. https://doi.org/10.29259/jep.v15i1.8821

Sitorus, F. D. (2020). Pengaruh Perdagangan Internasional Terhadap Nilai Tukar Rupiah. Quantitative Economics Journal, 7(3), 156–173. https://doi.org/10.24114/qej.v7i3.17559

Sugiyono. (2016). Metode Penelitian Kuantitatif, Kualitatif dan R&D. PT Alfabet.

Wijayanti, Y., & Sudarmiani. (2017). Pengaruh Ringkat Inflasi Terhadap Nilai Tukar Rupiah. Jurnal Equilibrium, 5(1). https://doi.org/10.25273/equilibrium.v5i1.1004

World Bank. (2022a). Inflasi, harga konsumen (% tahunan) - Indonesia. The World Bank. https://data.worldbank.org/indicator/FP.CPI.TOTL.ZG?locations=ID

World Bank. (2022b). Pertumbuhan PDB (% tahunan) - Indonesia. The World Bank. https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?locations=ID

Yudha, A. El, & Hadi, S. (2019). Analisis Pengaruh Inflasi, Suku Bunga, Neraca Perdagangan dan Pertumbuhan Ekonomi Terhadap Nilai Tukar Rupiah Indonesia. Jurnal Ekonomi Pembangunan, 7.

Downloads

Published

Issue

Section

License

Copyright (c) 2023 Firsty Ramadhona Amalia Lubis; Murtaza Hussain, Rully Firmansyah, Lusmino Basia

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.