The Role of Fiscal Decentralization on Inequality: Evidence from Papua Province

DOI:

https://doi.org/10.12928/jampe.v5i1.14475Keywords:

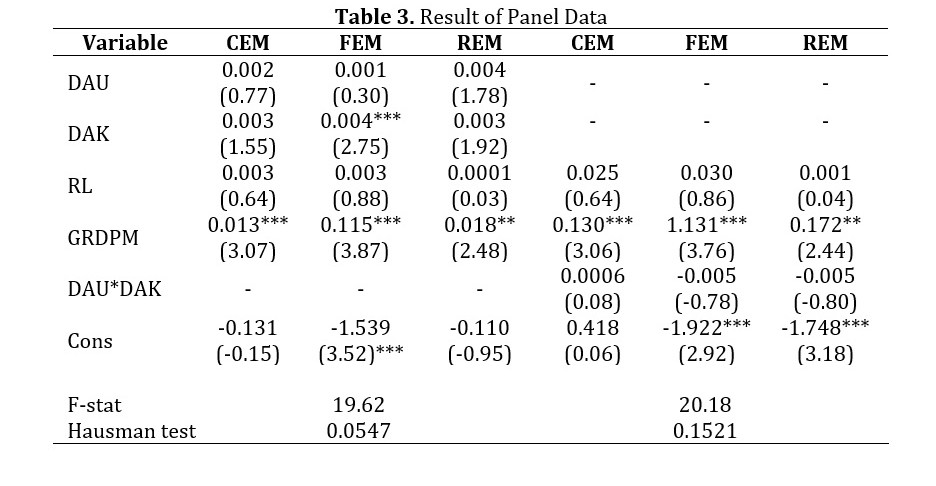

Fiscal decentralization, Inequality, Panel data, Unconditional transferAbstract

High income inequality is generally accompanied by unequal access to

education, job training, and business opportunities, limiting

employment opportunities for the poor. One approach that can be

applied to resolve this problem is by implementing a fiscal

decentralization policy. Papua is one of the regions categorized as 3T

(Underdeveloped, Frontier, and Outermost). This condition indicates

serious challenges in development in Papua, especially in the aspects of

basic infrastructure and fiscal independence. The main contribution of

the study is to analyze the role of fiscal decentralization on development

in Papua province. Fiscal decentralization plays an important role in

promoting regional development, particularly in disadvantaged areas.

The study used a panel data approach that combines time-series data

(2019-2023) and cross-sectional data (29 regencies and cities) in Papua

Province. The results of the study indicate that fiscal decentralization

through the General Allocation Fund (DAU) and Special Allocation Fund

(DAK) has no effect in reducing inequality rates in Papua Province. It is

due to geographical challenges and the unconditional transfer nature of

DAU and DAK. In this case, DAU is mostly used for regional routine

expenditures, while the DAK has a long-term effect on infrastructure

development, which is the major obstacle in reducing inequality in

Papua. This research implies that local governments need to improve the

effectiveness of DAU and DAK utilization by prioritizing productive

sectors.

References

References

A’yun, I. Q., Vianti, W. O., & Zalina, Z. (2022). Determinants of original local government revenue (PAD): Case studies of 34 provinces in Indonesia. Journal of Asset Management and Public Economy (JAMPE), 1(2). https://doi.org/10.12928/jampe.v1i2.6046

Adriana, M. (2024). Determinasi ketimpangan wilayah Kabupaten/Kota Provinsi Jawa Tengah (2010-2020). Jurnal Ekonomi Trisakti, 4(1), 805-818. https://doi.org/10.25105/jet.v4i1.17448

Anggraeni, R. M., Khusaini, M., & Prasetyia, F. (2022). Fiscal decentralization and its effect on poverty alleviation: Case study of Indonesia. Bulletin of Islamic Economics, 1(2), 35-48. https://doi.org/10.14421/bie.2022.012-04

Ashfahany, A. E., Djuuna, R. F., & Rofiq, N. F. (2020). Does fiscal decentralization increases regional income inequality in Indonesia? Jambura Equilibrium Journal, 2(2), 68-80. https://doi.org/10.37479/jej.v2i2.6866

Aulia, H. H., & Sari, D. R. P. (2025). Provincial Economic Convergence in Post-Decentralization Indonesia: A Panel Analysis from 2000 to 2022, Jurnal Ekonomi Pembangunan, 14(3), 73-85. https://doi.org/10.23960/jep.v14i3.4269

Baltagi, B. H. (2021). Econometric Analysis of Panel Data. 6th Edition. John Wiley & Sons.

Basia, L., Afriyanti, & Kurniawan, M. L. A. (2025). Pengaruh DAK, DAU, PAD, DBH, UMR & Angkatan Kerja Terhadap Belanja Modal Di Provinsi Jawa Tengah. Jurnal Ilmiah Raflesia Akuntansi, 11(1), 465–474. https://doi.org/10.53494/jira.v11i1.883

Borissov, K., & Hashimzade, N. (2022). Fiscal policy and inequality in a model with endogenous positional concerns. Journal of Mathematical Economics, 103, 102765. https://doi.org/10.1016/j.jmateco.2022.102765

Burdam, J., & Laka, B. M. (2022). Efektivitas dana otonomi khusus dalam menjawab kebutuhan masyarakat asli Papua di Kabupaten Biak Numfor. Jurnal Inovasi Penelitian, 2(12), 4219–4228. http://doi.org/10.47492/jip.v2i12.1530

Canavire-Bacarreza, G., Martinez-Vazquez, J., & Yedgenov, B. (2020). Identifying and disentangling the impact of fiscal decentralization on economic growth. World Development, 127, 104742. https://doi.org/10.1016/j.worlddev.2019.104742

Causa, O., & Hermansen, N. M. (2018). Income redistribution through taxes and transfers across OECD countries. No. 729, LIS Working Paper Series).

Chandra, D., Hidayat, S., & Rosmeli. (2017). Dampak dana perimbangan terhadap pertumbuhan ekonomi dan ketimpangan antar daerah di Provinsi Jambi. Jurnal Paradigma Ekonomi, 12(2), 67–76. https://doi.org/10.22437/paradigma.v12i2.3942

Direktorat Jenderal Perimbangan Keuangan. (2024). Alokasi dan realisasi dana transfer ke daerah tahun 2014–2024. Kementerian Keuangan Republik Indonesia.

Erica, D., Ratiyah, R., & Shah, S. M. A. R. (2025). Analysis of public sector financial performance with the value for money approach in Bogor Regency. Journal of Asset Management and Public Economy (JAMPE), 4(1), 17–29. https://doi.org/10.12928/jampe.v4i1.11566

Feld, L. P., Frey, C., Schaltegger, C. A., & Schmid, L. A. (2021). Fiscal federalism and income inequality: An empirical analysis for Switzerland. Journal of Economic Behavior & Organization, 185, 463–494. https://doi.org/10.1016/j.jebo.2021.02.028

Filippetti, A., & Sacchi, A. (2016). Decentralization and economic growth reconsidered: The role of regional authority. Environment and Planning C: Politics and Space, 34(8), 1793-1824. https://doi.org/10.1177/0263774X16642230

Gu, C., & Zhang, J. (2024). Fiscal decentralization, audit supervision and responsiveness of subnational governments: empirical evidence from Fiscal expenditure of municipal governments to meet basic living needs. Finance Trade Economy, 45, 21–37. https://cmjj.ajcass.com/waf_text_verify.html

Hayat, N. Z., Kurniawan, M. L. A., & Wong, W.-K. (2023). The role of inequality in Indonesia: Does fiscal decentralization matter? Jurnal Ekonomi Dan Studi Pembangunan, 15(2), 111–120. https://citeus.um.ac.id/jesp/vol15/iss2/2/

Huynh, C. M., Nguyen, T. L., & Lam, T. H. T. (2023). Fiscal decentralization and income inequality in OECD countries: does shadow economy matter? Eurasian Economic Review, 13, 515–533. https://doi.org/10.1007/s40822-023-00241-z

Hyunh, C. M., & Nguyen, T. L. (2020). Shadow economy and income inequality: new empirical evidence from Asian developing countries. Journal of the Asia Pacific Economy, 25(1), 175–192. https://doi.org/10.1080/13547860.2019.1643196

Ilyasa, W. N., Kurniawan, M. L. A., Lubis, F. R. A., & Salim, A. (2025). The role of credit for poverty alleviation in Indonesia: Evidence from panel data analysis. Integrated Journal of Business and Economics, 9(2), 203–217. http://dx.doi.org/10.33019/ijbe.v9i2.1101

Indrawati, I. (2020). Analisis pengaruh pertumbuhan ekonomi, ketimpangan distribusi pendapatan dan indeks pembangunan manusia terhadap tingkat kemiskinan Provinsi Papua tahun 2014-2019. Dinamic, 2(4), 1068–1080. http://doi.org/10.31002/dinamic.v2i4.1446

Konstantinou, P. T. (2024). Fiscal consolidations and income inequality: Evaluating the evidence. The Quarterly Review of Economics and Finance, 97, 101880. https://doi.org/10.1016/j.qref.2024.101880

Latifah, L., & Rahayu, D. (2019). Pengaruh desentralisasi fiskal dan pertumbuhan ekonomi terhadap ketimpangan antar daerah. Jurnal Ilmu Ekonomi Dan Pembangunan, 2(4), 983–994. https://jiep.ulm.ac.id/index.php/jiep/article/view/2387

Liu, Y., & Dong, C. (2025). Digital finance, social welfare investment, and urban–rural income inequality: moderating role of regional economics and regional disparities. Finance Research Letters, 77, 107077. https://doi.org/10.1016/j.frl.2025.107077

Madakarah, N. Y., & Makaliwe, W. A. (2023). Efektivitas kebijakan desentralisasi fiskal pada pertumbuhan ekonomi dan ketimpangan pendapatan antardaerah. Jurnal Manajemen Bisnis Dan Keuangan, 4(2), 158-169. https://doi.org/10.51805/jmbk.v4i2.132

Marlin, W., & Hukom, A. (2023). Pengaruh kemandirian dan desentralisasi fiskal terhadap penyerapan tenaga kerja di Provinsi Kalimantan Tengah. Jurnal Ekonomi Integra, 13(1), 154-163. https://doi.org/10.51195/iga.v13i1.236

Melmambessy, D. (2022). Analisis kinerja keuangan pemerintah Kota Jayapura ditinjau dari rasio kemandirian daerah, ketergantungan daerah, desentralisasi fiskal dan efektivitas. Jurnal Ekonomi & Bisnis Sekolah Tinggi Ilmu Ekonomi Port Numbay Jayapura, 13(2), 154-163. https://doi.org/10.55049/p341e341

Moundigbaye, M., Rea, W. S., & Reed, W. R. (2018). Which panel data estimator should I use?: A corrigendum and extension. Economics, 12, 1–31. https://doi.org/10.5018/economics-ejournal.ja.2018-4

Nie, C., Wang, H., & Feng, Y. (2024). Urban-biased policy, government intervention and urban-rural income gap: evidence from provincial government work reports in China. Kybernetes: The International Journal of Cybernetics, Systems and Management Sciences, 53(11), 4929–4947. https://doi.org/10.1108/K-01-2023-0084

Porta, D. D., Galbraith, J., & Pianta, M. (2022). Introduction to the special issue ‘The political consequences of inequality.’ Structural Change and Economic Dynamics, 60, 389–390. https://doi.org/10.1016/j.strueco.2021.11.019

Putri, D. Y., & Aminda, R. S. (2024). Analisis faktor-faktor yang mempengaruhi ketimpangan pendapatan di provinsi Daerah Istimewa Yogyakarta. Journal of Development Economic and Digitalization, 3(1), 87–108. https://doi.org/10.59664/jded.v3i1.7667

Putri, H. T., Susetyo, D., Marissa, F., & Sukanto, S. (2023). The effect of economic growth, fiscal decentralization, fiscal stress, and economic openness on regional inequality. Jurnal Ekonomi Pembangunan, 20(2), 181–192. https://doi.org/10.29259/jep.v20i2.19113

Rachmawati, L. N., Lubis, F. R. A., & Azzakiyyah, N. A. (2025). Regional income disparities in Indonesia: Insights from the Williamson index and panel data analysis. Optimum: Jurnal Ekonomi Dan Pembangunan, 15(2), 264–271. https://doi.org/10.12928/optimum.v15i2.12953

Rasbin. (2016). Desentralisasi fiskal dan stabilitas makroekonomi: Studi kasus di Indonesia. Kajian, 21(1), 17–35. https://doi.org/10.22212/kajian.v21i1.765

Santoso, F. D. P., & Mukhlis, I. (2021). Ketimpangan pendapatan dan faktor-faktor yang mempengaruhi pada masa sebelum dan pada saat pandemi COVID-19 di Indonesia. Jurnal Ekonomi, Bisnis Dan Pendidikan, 1(2), 146-162. https://doi.org/10.17977/um066v1i22021p146-162

Sari, Y. P. (2025). Dapatkah dana alokasi khusus, dana alokasi umum dan dana bagi hasil menurunkan ketimpangan pendapatan di Indonesia? Jurnal Ekonomi Al-Khitmah, 7(1), 13–25. https://doi.org/10.36378/khitmah.v7i1.4061

Shahbaz, M., Rizvi, S. K. A., Dong, K., & Vo, X. V. (2022). Fiscal decentralization as new determinant of renewable energy demand in China: The role of income inequality and urbanization. Renewable Energy, 187, 68–80. https://doi.org/10.1016/j.renene.2022.01.064

Siburian, M. E. (2020). Fiscal decentralization and regional income inequality: evidence from Indonesia. Applied Economics Letters, 27(17), 1383–1386. https://doi.org/10.1080/13504851.2019.1683139

Siburian, M. E. (2022). The link between fiscal decentralization and poverty – Evidence from Indonesia. Journal of Asian Economics, 81, 101493. https://doi.org/10.1016/j.asieco.2022.101493

Song, Y. (2013). Rising Chinese regional income inequality: The role of fiscal decentralization. China Economic Review, 27, 294–309. https://doi.org/10.1016/j.chieco.2013.02.001

Stigler, G. J. (1998). The tenable range of functions of local government. International Library of Critical Writings in Economics, 88, 3–8. https://www.econbiz.de/Record/the-tenable-range-of-functions-of-local-government-stigler-george/10002858875

Tang, L., & Sun, S. (2022). Fiscal incentives, financial support for agriculture, and urban-rural inequality. International Review of Financial Analysis, 80, 102057. https://doi.org/10.1016/j.irfa.2022.102057

Umar, H. B., Ngutra, R. N., & Maga, L. (2021). Analisis dampak kebijakan pemerintah terhadap perkembangan perekonomian pada wilayah adat Mamta Provinsi Papua. Jurnal Kajian Ekonomi Dan Studi Pembangunan, 8(2), 1-6. https://doi.org/10.56076/jkesp.v8i2.2108

Winchester, M. S., & King, B. (2018). Decentralization, healthcare access, and inequality in Mpumalanga, South Africa. Health & Place, 51, 200–207. https://doi.org/10.1016/j.healthplace.2018.02.009

Zhang, F., Guo, P., & Fan, X. (2025). Can fiscal support reduce the income gap between urban and rural residents? An analysis based on heterogeneity and threshold effects. Finance Research Letters, 80, 107353. https://doi.org/10.1016/j.frl.2025.107353

Zhang, X., Zhu, Y., & Hou, A. (2025). Fiscal decentralization and urban-rural inequality of income acquisition opportunities: Micro evidence from China. Finance Research Letters, 85(Part A), 107859. https://doi.org/10.1016/j.frl.2025.107859

Downloads

Published

Issue

Section

License

Copyright (c) 2026 Fitra Prasapawidya Purna, Putri Hardiningsih, Mahrus Lutfi Adi Kurniawan, Lestari Sukarniati, Stanislaw Flejterskie

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.