Macroeconomic and Institutional Determinants of ASEAN Middle Income Trap: Evidence from 2014–2023

DOI:

https://doi.org/10.12928/jampe.v5i1.13910Keywords:

ASEAN economies, Foreign direct investment, Human development , Institutional quality , Middle-income trapAbstract

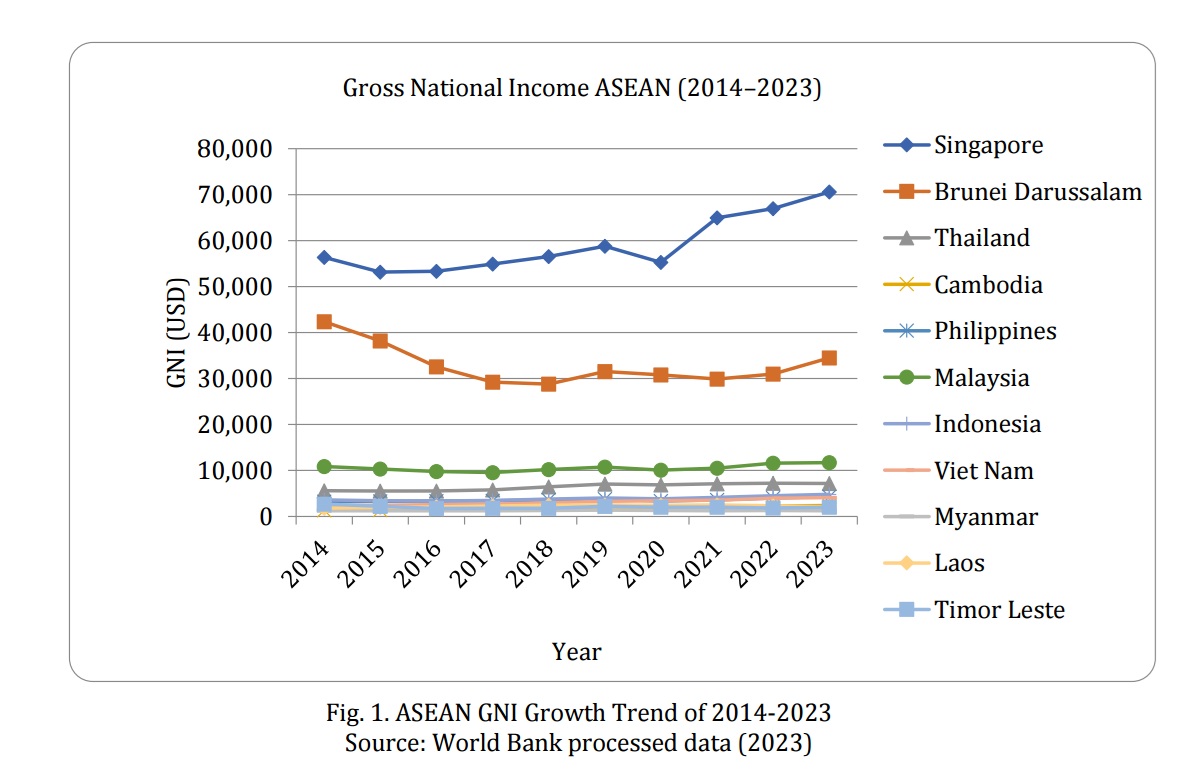

This study aimed to analyze the effect of Foreign Direct Investment (FDI), Human Development Index (HDI), Corruption Perception Index (CPI), and inflation on Gross National Income (GNI) per capita in 11 ASEAN countries during the period 2014–2023. In addition, this study evaluates the differences in GNI levels between countries that remain trapped in the Middle Income Trap (MIT) and those that have successfully escaped it. The method used was panel data regression with the Random Effect Model approach. The results showed that FDI and HDI have a significant positive effect on GNI per capita, whereas CPI has a significant negative effect. Inflation has no significant effect. The MIT dummy variable also has a significant negative effect, indicating that countries that remain in the MIT tend to have lower per capita income levels compared to countries that have successfully escaped. These findings reinforce the importance of the role of institutional quality and

human development in increasing national income. This study contributes to the development economics literature by highlighting the importance of macroeconomic and institutional variables in explaining income disparities in the ASEAN region.

References

Abasimi, I., Nabila, A., Ramdhan, M. A., & Anam, M. S. (2025). Determinants of residential property price in selected Asian countries: A Sys-GMM approach. Journal of Asset Management and Public Economy (JAMPE), 4(1). https://doi.org/10.12928/jampe.v4i1.11927

Anjarsari, L. (2025). Globalization, Corruption, and Gross Domestic Product in ASEAN Low Middle-Income. JBMR: Journal of Business and Management Review

Profesional Muda Cendekia Publising, 6(7), 817-830. https://doi.org/10.47153/jbmr.v6i7.1639

Ang, J. P., & Dong, F. (2023). Middle-income trap and corruption: Evidence from a dynamic panel data analysis. Research in Economics, 77(3), 349–361. https://doi.org/10.1016/j.rie.2023.06.003

ASEAN+3 Macroeconomic Research Office. (2025). Inflation in ASEAN+3: Changing dynamics and policy implications (Chapter 2). In ASEAN+3 regional economic outlook 2025. https://amro-asia.org/wp-content/uploads/2025/04/Chapter-2.pdf

Bahrami, F., Shahmoradi, B., Noori, J., Turkina, E., & Bahrami, H. (2023). Economic complexity and the dynamics of regional competitiveness a systematic review. Competitiveness Review: An International Business Journal, 33(4), 711-744. https://doi.org/10.1108/CR-06-2021-0083

Behuria, P. & Sumner, A. (2025), Middle-income Trap or Neoliberal Trap? Industrial Policy and Ideology in the World Development Report 2024. Dev Change, 56, 1061-1083. https://doi.org/10.1111/dech.70013

Bianchi, C., Isabella, F., Martinis, A., & Picasso, S. (2024). Varieties of middle-income trap: Heterogeneous trajectories and common determinants. Structural Change and Economic Dynamics, 71, 320–336. https://doi.org/10.1016/j.strueco.2024.08.008

Bresser-Pereira, L. C., Araújo, E. C., & Peres, S. C. (2020). An alternative to the middle-income trap. Structural Change and Economic Dynamics, 52, 294–312. https://doi.org/10.1016/j.strueco.2019.11.007

Demena, B. A., & van Bergeijk, P. A. G. (2019). Observing FDI spillover transmission channels. Third World Quartely, 117, 134–146. https://doi.org/10.1080/01436597.2019.1596022

Eldeib, M. A. M., Maulana, M. R. P., & Nasir, M. S. (2025). The impact of MSMEs, population, road infrastructure, and human development index on GRDP in Central Java. Journal of Asset Management and Public Economy (JAMPE), 4(1), 1–16. https://doi.org/10.12928/jampe.v4i1.11599

Grabowski, R., & Self, S. (2020). What factors influence the quality of governance institutions? An Asian perspective. Journal of Asian Economics, 70, 101238. https://doi.org/10.1016/j.asieco.2020.101238

Gülcemal, T. (2020). Effect of human development index on GDP for developing countries: a panel data analysis. Pressacademia, 7(4), 338–345.http://doi.org/10.17261/Pressacademia.2020.1307

Gründler, K., & Potrafke, N. (2019). Corruption and economic growth: New empirical evidence. European Journal of Political Economy, 60, 101810. https://doi.org/10.1016/j.ejpoleco.2019.08.001

Hamilton, C., & de Vries, G. J. (2025). The structural transformation of transition economies. World Development, 191, 106977. https://doi.org/10.1016/j.worlddev.2025.106977

Hidayat, D. N., & Yusuf, A. A. (2024). Dampak Investasi Asing, Inflasi, Indeks Pemberdayaan Gender, Dan Indeks Persepsi Korupsi Pada Pertumbuhan Ekonomi Indonesia. Journal of Economics Research and Policy Studies, 4(2), 263–276. https://doi.org/10.53088/jerps.v4i2.1113

Ibrahim, C. (2021). Corruption, public debt and economic growth – evidence from developing countries. International Journal of Development Issues, 20(1), 24–37, https://doi.org/10.1108/IJDI-12-2019-0208

Islam, M.S. (2020). Human Capital and Per Capita Income Linkage in South Asia: A Heterogeneous Dynamic Panel Analysis. J Knowl Econ, 11, 1614–1629. https://doi.org/10.1007/s13132-020-00637-1

Kurniawan, M. L. A., & A’yun, I. Q. (2022). Dynamic analysis on export, FDI and growth in Indonesia: An autoregressive distributed lag (ARDL) model. Journal of Economics, Business, & Accountancy Ventura, 24(3), 350–362. https://doi.org/10.14414/jebav.v24i3.2717

Le-Bao, T., Bao, N. H., & Thanh, N. T. (2025). The effects of foreign direct investment on the Human Development Index: Analysis of different income countries. SAGE Open, 15(3). https://doi.org/10.1177/21582440251379216

Masatoshi, H. (2024). China-ASEAN economic ties: Balancing growth amid middle-income challenges and opportunities. SocioEconomic Challenges, 8(1).10.61093/sec.8(1).31-51.2024

Maulana, A & Suprapti, I. (2025). Do Inflation, Labor, FDI, and External Debt Influence Economic Growth? Evidence from ASEAN Countries During the Fintech 3.0. Journal of Enterprise and Development, 7. 66-78. https://doi.org/10.20414/jed.v7i1.12710.

Moiseev, N., Mikhaylov, A., Varyash, I., & Saqib, A. (2020). Investigating the relation of GDP per capita and corruption index. Entrepreneurship and Sustainability Issues, 8(1): 780-794. https://doi.org/10.9770/jesi.2020.8.1(52)

Palma, J. G., & Pincus, J. (2024). Is Southeast Asia falling into a Latin American-style middle-income trap? The Japanese Political Economy, 50(3–4), 305–337. https://doi.org/10.1080/2329194X.2024.2430255

Putri, M. V. L., & Purnamadewi, Y. L. (2024). Dampak Korupsi Terhadap Produktivitas di Negara-Negara Middle-Income Trap (MIT ). Jurnal Ekonomi dan Kebijakan Pembangunan. 13(1), 60–79. https://doi.org/10.29244/jekp.13.1.2024.60-79

Puttitanun, T., & Lerskullawat, A. (2025). Human development and economic growth: who benefits the most? Applied Economics, 1–18. https://doi.org/10.1080/00036846.2025.2558238

Rehman, M. A., Bashir, F., Rashid, M. K., & Hussain, A. (2023). Corruption-Growth Nexus in the Emerging Market Economies: Empirical Evidence Using Panel Data. IRASD Journal of Economics, 5(1), 140–148. https://doi.org/10.52131/joe.2023.0501.0117

Ricz, J. (2021). The Anatomy of the Newly Emerging Illiberal Model of State Capitalism: A Developmental Dead End? International Journal of Public Administration, 44(14), 1253–1263. https://doi.org/10.1080/01900692.2021.1874984

Saha, S., & Gounder, R. (2019). Corruption and economic development: A nonlinear analysis. Journal of Economic Studies, 46(4), 838–856. https://doi.org/10.1108/JES-11-2017-0328

Sahid, M., & Purnomo, D. (2024). Seberapa Besar Dampak Ketimpangan Terhadap Pendapatan Nasional Bruto per Kapita di Negara-Negara G20. Menara Ekonomi, 10(2), 10–19. https://doi.org/10.31869/me.v10i2.5279

Shaari, M. S., Esquivias, M. A., Ridzuan, A. R., Fadzilah Zainal, N., & Sugiharti, L. (2022). The impacts of corruption and environmental degradation on foreign direct investment: new evidence from the ASEAN+3 countries. Cogent Economics & Finance, 10(1). https://doi.org/10.1080/23322039.2022.2124734

Suhardi, R. Y., & Rahman, A. (2025). Analysis of factors affecting the level of corruption: a study of ASEAN countries. Journal of Contemporary Accounting, 6(3), 201–213. https://doi.org/10.20885/jca.vol6.iss3.art5

Spyromitros, E., & Panagiotidis, M. (2022). The impact of corruption on economic growth in developing countries and a comparative analysis of corruption measurement indicators. Cogent Economics and Finance, 10(1), 1-30. https://doi.org/10.1080/23322039.2022.2129368

Szirmai, A. (2012). Industrialisation as an engine of growth in developing countries, 1950–2005. Structural Change and Economic Dynamics, 23, 406–420. https://doi.org/10.1016/j.strueco.2011.01.005

Wang, X., Xu, Z., Qin, Y., & Skare, M. (2022). Foreign direct investment and economic growth: a dynamic study of measurement approaches and results. Economic Research-Ekonomska Istraživanja, 35(1), 1011–1034. https://doi.org/10.1080/1331677X.2021.1952090

Yahya, C. N., Zaki, B. M., Ab Wahab, S. N. A., Bin Roslan, M. H., & Mat Rawi, F. B. F. (2024). Determinants of Inflation Rate Fluctuations in Five ASEAN Nations. Information Management and Business Review, 16, 817-830. https://doi.org/10.22610/imbr.v16i3S(I)a.4238

Downloads

Published

Issue

Section

License

Copyright (c) 2026 Alfira Nabila, Jamzani Sodik, Didi Nuryadin

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.