Revisiting The Finance-Innovation Nexus: Evidence from Asia

DOI:

https://doi.org/10.12928/jampe.v4i2.12984Keywords:

Bank Lending, Finance-innovation , Monetary PolicyAbstract

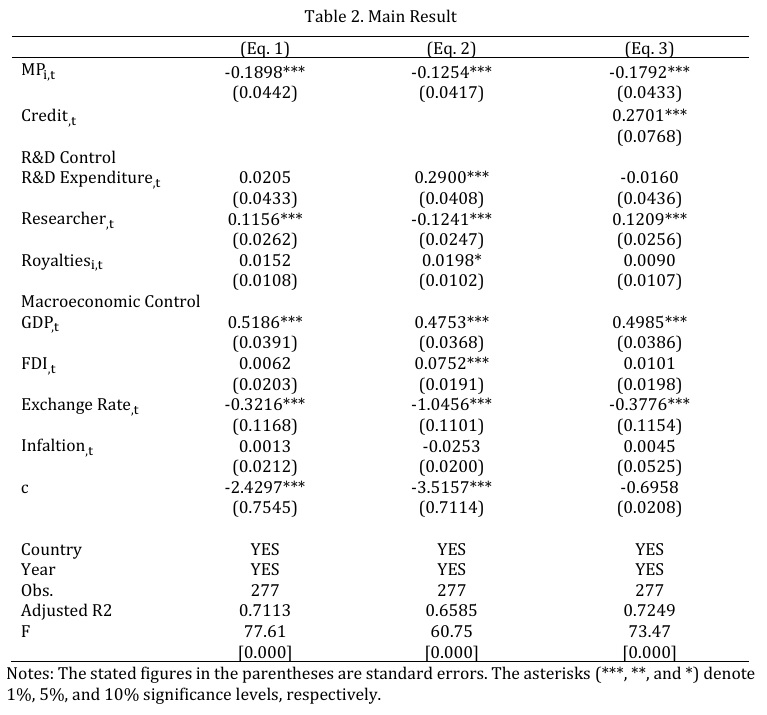

Since a few studies have analysed the long-run impact of monetary

policy, this study aims to contribute to this gap by revisiting the

Schumpeterian finance-innovation nexus and examining the influence of

monetary policy, as well as the mediating function of bank lending, on

technological innovation across Asian economies. This study employs a

fixed-effect model (FEM) to analyse a cross-country dataset of Asian

economies from 2002 to 2023. The finding reveals the direct and

indirect correlation between monetary policy and innovation, as

determined through mediating regression analysis. Furthermore, our

study offers empirical evidence supporting a correlation between

financial development and national innovation. This finding holds across

several primary, robustness, and endogeneity analyses. Furthermore,

this study also found that the direct and indirect effects of monetary

policy on national innovation are more pronounced in upper-middle-

and high-income countries. This study confirms that enhanced bank

lending, facilitated by appropriate monetary policy, has a favourable and

statistically significant impact on national innovation.

References

Alper, K., Binici, M., Demiralp, S., Kara, H., & ÖZLÜ, P. (2018). Reserve Requirements, Liquidity Risk, and Bank Lending Behavior. Journal of Money, Credit and Banking, 50(4), 817–827. https://doi.org/10.1111/jmcb.12475

Andrieș, A. M., Melnic, F., & Nistor, S. (2018). Effects of macroprudential policy on systemic risk and bank risk taking. Finance a Uver - Czech Journal of Economics and Finance, 68(3), 202–244. https://doi.org/10.2139/ssrn.3021278

Andrieş, A. M., Melnic, F., & Sprincean, N. (2022). The effects of macroprudential policies on credit growth. European Journal of Finance, 28(10), 964–996. https://doi.org/10.1080/1351847X.2021.1939087

Ang, J. B. (2014). Innovation and financial liberalization. Journal of Banking and Finance, 47(1), 214–229. https://doi.org/10.1016/j.jbankfin.2014.07.007

Anwar, C. J., Suhendra, I., Didu, S., Sayektiyani, A., & Kholishoh, L. N. (2023). The impact of monetary policy and credit risk on bank credit behavior: An analysis of banks listed on the Indonesian stock exchange. Cogent Economics and Finance, 11(1). https://doi.org/10.1080/23322039.2023.2220250

Bakhouche, A. (2022). Assessing the Innovation-finance Nexus for SMEs: Evidence from the Arab Region (MENA). Journal of the Knowledge Economy, 13(3), 1875–1895. https://doi.org/10.1007/s13132-021-00786-x

Baron, R. M., & Kenny, D. A. (1986). The Moderator-Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. Journal of Personality and Social Psychology, 51(6), 1173–1182. https://doi.org/10.1037/0022-3514.51.6.1173

Belgibayeva, A., Samoilikova, A., Vasylieva, T., & Lieonov, S. (2022). Influence Of Monetary Policy Instruments And Indicators On Dynamics Of Financing Innovation: Empirical Evidence. Financial and Credit Activity: Problems of Theory and Practice, 3(44), 30–42. https://doi.org/10.55643/fcaptp.3.44.2022.3798

Bianco, T. (2021). Monetary policy and credit flows. Journal of Macroeconomics, 70. https://doi.org/10.1016/j.jmacro.2021.103362

Brancati, E. (2015). Innovation financing and the role of relationship lending for SMEs. Small Business Economics, 44(2), 449–473. https://doi.org/10.1007/s11187-014-9603-3

Carvelli, G., Bartoloni, E., & Baussola, M. (2024). Monetary policy and innovation in Europe: An SVAR approach. Finance Research Letters, 66. https://doi.org/10.1016/j.frl.2024.105730

de Bandt, O., Lecarpentier, S., & Pouvelle, C. (2021). Determinants of banks’liquidity: A French perspective on interactions between market and regulatory requirements. Journal of Banking and Finance, 124. https://doi.org/10.1016/j.jbankfin.2020.106032

Dou, Y., & Xu, Z. (2021). Bank Lending and Corporate Innovation: Evidence from SFAS 166/167*. Contemporary Accounting Research, 38(4), 3017–3052. https://doi.org/10.1111/1911-3846.12716

Evers, M., Niemann, S., & Schiffbauer, M. (2020). Inflation, liquidity and innovation. European Economic Review, 128. https://doi.org/10.1016/j.euroecorev.2020.103506

Feng, L., Pei, T., & Zhou, Z. (2024). The impact of U.S. monetary policy on Chinese firms’ innovation. International Review of Economics and Finance, 92, 1097–1111. https://doi.org/10.1016/j.iref.2024.02.006

Giebel, M., & Kraft, K. (2020). Bank credit supply and firm innovation behavior in the financial crisis. Journal of Banking and Finance, 121. https://doi.org/10.1016/j.jbankfin.2020.105961

Kim, J., Kim, S., & Park, D. (2020). Monetary policy shocks and exchange rates in Asian countries. Japan and the World Economy, 56. https://doi.org/10.1016/j.japwor.2020.101041

Liu, P., & Li, H. (2020). Does bank competition spur firm innovation? Journal of Applied Economics, 23(1), 519–538. https://doi.org/10.1080/15140326.2020.1806001

Liu, T., Wang, J., Rathnayake, D. N., & Louembé, P. A. (2022). The Impact of Commercial Credit on Firm Innovation: Evidence from Chinese A-Share Listed Companies. Sustainability (Switzerland), 14(3). https://doi.org/10.3390/su14031481

Liu, X., Liu, T. H., & Chen, K. G. (2018a). Does Bank Loan Promote Enterprise Innovation? Procedia Computer Science, 154, 783–789. https://doi.org/10.1016/j.procs.2019.06.121

Liu, X., Liu, T. H., & Chen, K. G. (2018b). Does Bank Loan Promote Enterprise Innovation? Procedia Computer Science, 154, 783–789. https://doi.org/10.1016/j.procs.2019.06.121

Liu, X., & Zhao, Q. (2024). Banking competition, credit financing and the efficiency of corporate technology innovation. International Review of Financial Analysis, 94. https://doi.org/10.1016/j.irfa.2024.103248

Lyu, X., Ma, J., & Zhang, X. (2023). Social trust and corporate innovation: An informal institution perspective. North American Journal of Economics and Finance, 64. https://doi.org/10.1016/j.najef.2022.101829

Ma, Y., & Zimmermann, K. (2023). MONETARY POLICY AND INNOVATION. In NBER WORKING PAPER SERIES (w31698). Available at SSRN: https://ssrn.com/abstract=4574643

Meierrieks, D. (2014). Financial development and innovation: Is there evidence of a schumpeterian finance-innovation nexus? Annals of Economics and Finance, 15(2), 343–363. Available at AECON: http://www.aeconf.com/Articles/Nov2014/aef150205.pdf

Olszak, M., & Kowalska, I. (2022). Does bank competition matter for the effects of macroprudential policy on the procyclicality of lending? Journal of International Financial Markets, Institutions and Money, 76(January 2021). https://doi.org/10.1016/j.intfin.2021.101484

Salim, A., Suripto, S., Yuniarti, D., Abasimi, I., Zakiyyah, N. A. A., & A’yun, I. Q. (2024). Research elevation of bank lending and technological innovation in the excess liquidity countries. Heliyon, 10(13). https://doi.org/10.1016/j.heliyon.2024.e33462

Schumpeter, J. A. (1912). Theorie der wirtschaftlichen Entwicklung (Theory of economic growth). Von Dunker and Humbolt.

Schumpeter, J. A. (1949). The Theory of Economic Development: An Inquiry Into Profits, Credit, Interest, and the Business Cycle. In Social Science Electronic Publishing (Vol. 25, Issue 1, p. 255). https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1496199

Spatareanu, M., Manole, V., & Kabiri, A. (2019). Do bank liquidity shocks hamper firms’ innovation? International Journal of Industrial Organization, 67. https://doi.org/10.1016/j.ijindorg.2019.06.002

Tian, J., Li, H., & You, P. (2022). Economic policy uncertainty, bank loan, and corporate innovation. Pacific Basin Finance Journal, 76(September), 101873. https://doi.org/10.1016/j.pacfin.2022.101873

Tian, L., Han, L., & Mi, B. (2020). Bank competition, information specialization and innovation. Review of Quantitative Finance and Accounting, 54(3), 1011–1035. https://doi.org/10.1007/s11156-019-00815-6

Wang, X. (2023). Stock market, credit market, and heterogeneous innovations. International Review of Finance, 23(1), 103–129. https://doi.org/10.1111/irfi.12390

Yang, H. C., Chang, C. P., Sahminan, Rishanty, A., & Wang, Q. J. (2024). The Nexus Between Monetary Policy, Innovation Efficiency, and Total Factor Productivity-Evidence from Global Panel Data. Emerging Markets Finance and Trade, 60(2), 292–309. https://doi.org/10.1080/1540496X.2023.2218964

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Jun Wen, Maria Fernanda Chima Hernandez, Agus Salim

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.