Integrating Qualitative and Quantitative Methods in Sustainable Finance to Guide Public Policy for Green Investments

DOI:

https://doi.org/10.12928/jampe.v4i2.11705Keywords:

Energy Transition, Green Technology, Renewable Energy, Sustainable Finance, Sustainable InvestmentAbstract

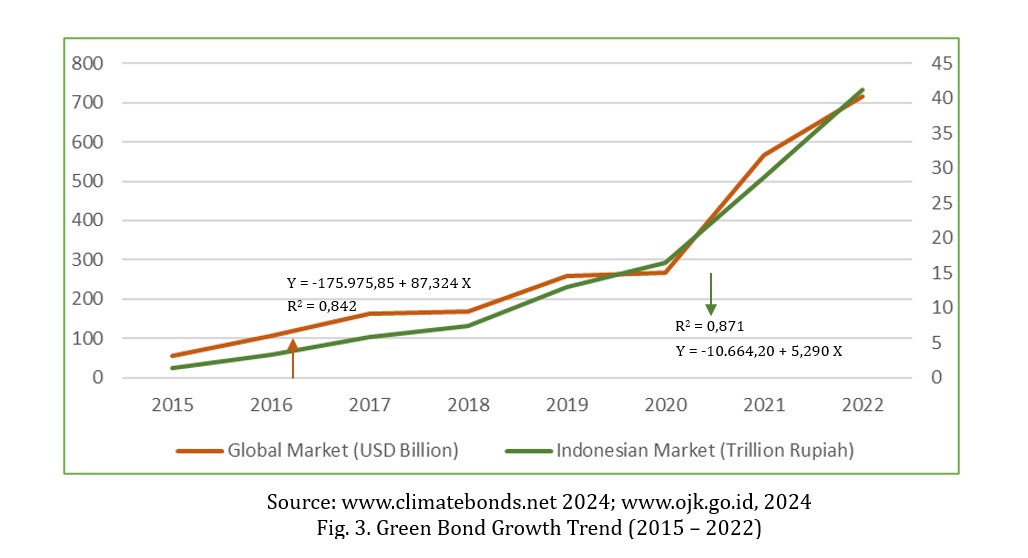

This study investigates the role of sustainable finance in advancing investments in renewable energy and green technologies while addressing associated challenges and opportunities. The research aims to analyze the impact of sustainable finance strategies on investment flows, identify key barriers to their effective implementation, and propose strategic recommendations to enhance investment in this sector. This study seeks to support the global transition to a greener and more sustainable economy by optimizing policies, funding mechanisms, and financial practices. Using a mixed-methods approach, this study integrates qualitative and quantitative analyses, including literature reviews, causality analyses, and country-specific case studies. Secondary data generated from industry reports, academic publications, and financial databases form the basis of the analysis. Findings from the Sustainable Finance-Investment Interaction Model reveal that sustainable finance significantly enhances renewable energy investments. However, high initial costs, policy uncertainty, and restricted access to finance remain substantial obstacles. Despite these challenges, opportunities driven by technological advancements and increasing global climate awareness provide a strong foundation for growth. This paper presents recommendations for governments, investors, and financial institutions to strengthen the role of sustainable finance in accelerating renewable energy investments. Emphasizing integrating environmental, social, and governance (ESG) factors into financial decision-making, the study highlights the need for supportive policies to address financing barriers. By aligning financial systems with sustainability objectives, this research contributes to the broader discourse on sustainable finance and underscores its transformative potential in driving the global green transition.

References

References

Ahmed, E. R., Islam, A., Alabdullah, T. T. Y., & Amran, A. (2019). A qualitative analysis on the determinants of legitimacy of sukuk. Journal of Islamic Accounting and Business Research, 10(3), 342-368. https://doi.org/10.1108/JIABR-01-2016-0005

Amesho, K. T. T., & Edoun, E. I. (2019). Financing Renewable Energy In Namibia - A Fundamental Key Challenge To The Sustainable Development Goal 7: Ensuring Access To Affordable, Reliable, Sustainable And Modern Energy For All. International Journal of Energy Economics and Policy, 9(5), 442-450. https://doi.org/10.32479/ijeep.7704

Androniceanu, A., & Sabie, O. M. (2022). Overview of Green Energy as a Real Strategic Option for Sustainable Development. Energies, 15(22), 1-35. https://doi.org/10.3390/en15228573

Anton, S. G., & Nucu, A. A. (2020). The effect of financial development on renewable energy consumption. A panel data approach. Renewable Energy, 147, 330–338. https://doi.org/10.1016/j.renene.2019.09.005

Apriliyanti, K., & Rizki, D. (2023). Kebijakan Energi Terbarukan: Studi Kasus Indonesia Dan Norwegia Dalam Pengelolaan Sumber Energi Berkelanjutan. Jurnal Ilmu Pemerintahan Widya Praja, 49(2), 186–209. https://doi.org/10.33701/jipwp.v49i2.36843246

Ari, I., & Koç, M. (2021). Philanthropic-crowdfunding-partnership: A proof-of-concept study for sustainable financing in low-carbon energy transitions. Energy, 222, 119925. https://doi.org/10.1016/j.energy.2021.119925

Azhgaliyeva, D., Beirne, J., & Mishra, R. (2022). What matters for private investment in renewable energy? Climate Policy, 23(1), 71–87. https://doi.org/10.1080/14693062.2022.2069664

Bogdanov, D., Ram, M., Aghahosseini, A., Gulagi, A., Oyewo, A. S., Child, M., Caldera, U., Sadovskaia, K., Farfán, J., de Souza Noel Simas Barbosa, L., Fasihi, M., Khalili, S., Traber, T., & Breyer, C. (2021). Low-cost renewable electricity as the key driver of the global energy transition towards sustainability. Energy, 227, 120467. https://doi.org/10.1016/j.energy.2021.120467

Candra, O., Chammam, A. M., Alvarez, J. R. N., Muda, I., & Aybar, H. S. (2023). The Impact of Renewable Energy Sources on the Sustainable Development of the Economy and Greenhouse Gas Emissions. Sustainability, 15(3), 2104. https://doi.org/10.3390/su15032104

Du, K., & Li, J. (2019). Towards a green world: How do green technology in-novations affect total-factor carbon productivity. Energy Policy, 131, 240-250. https://doi.org/10.1016/j.enpol.2019.04.033

Ebtke, H. (2021). Kunjungi Indonesia, Denmark Tegaskan Kembali Komitmen Kedua Negara pada Kemitraan Energi Hijau Pasca COP-26. Ebtke.Esdm.Go.Id. https://ebtke.esdm.go.id/post/2021/11/24/3015/kunjungi.indonesia.denmark.tegaskan.kembali.komitmen.kedua.negara.pada.kemitraan.energi.hijau.pasca.cop-26?lang=en

Ebtke, H. (2022). Pemerintah Perkuat Komitmen Transisi Energi Melalui Peraturan Presiden Pengembangan EBT. Ebtke.Esdm.Go.Id. https://ebtke.esdm.go.id/post/2022/10/07/3290/pemerintah.perkuat.komitmen.transisi.energi.melalui.peraturan.presiden.pengembangan.ebt

El-Kassar, A.-N., & Singh, S. K. (2019). Green innovation and organizational performance: The influence of big data and the moderating role of management commitment and HR practices. Technological Forecasting and Social Change, 144, 483-498. https://doi.org/10.1016/j.techfore.2017.12.016

Foglie, A. D., & Keshminder, J. S. (2022). Challenges and opportunities of SRI sukuk toward financial system sustainability: a bibliometric and systematic literature review. International Journal of Emerging Markets, 19(10), 3202-3225. https://doi.org/10.1108/IJOEM-04-2022-0601

Fu, J., & Ng, A. (2021). Scaling up Renewable Energy Assets: Issuing Green Bond via Structured Public-Private Collaboration for Managing Risk in an Emerging Economy. Energies, 14(11), 3076. https://doi.org/10.3390/en14113076

Hsiao, H.-F., Zhong, T., & Di̇nçer, H. (2019). Analysing Managers' Financial Motivation for Sustainable Investment Strategies. Sustainability, 11(4), 3849. https://doi.org/10.3390/su11143849

Huang, H.-Y., Chau, K. Y., Iqbal, W., & Fatima, A. (2021). Assessing the role of financing in sustainable business environment. Environmental Science and Pollution Research, 29, 7889–7906. https://doi.org/10.1007/s11356-024-34317-3

Jdihkemenkeugoid. (2023). Peraturan Menteri Keuangan Nomor 103 Tahun 2023 tentang Pemberian Dukungan Fiskal melalui Kerangkan Pendanaan dan Pembiayaan dalam Rangka Percepatan Transisi Energi di Sektor Ketenagalistrikan. 1–18.

Kabeyi, M. J. B., & Olanrewaju, O. A. (2022). Sustainable Energy Transition for Renewable and Low Carbon Grid Electricity Generation and Supply. Frontiers in Energy Research, 9, 743114. https://doi.org/10.3389/fenrg.2021.743114

Khan, A., Yang, C. H., Hussain, J., & Kui, Z. (2021). Impact of technological innovation, financial development and foreign direct investment on renewable energy, non-renewable energy and the environment in belt & Road Initiative countries. Renewable Energy, 171, 479–491. https://doi.org/10.1016/j.renene.2021.02.075

Khan, S., Akbar, A. J., Nasim, I., Hedvicaková, M., & Bashir, F. (2022). Green finance development and environmental sustainability: A panel data analysis. Frontiers in Environmental Science, 10. https://doi.org/10.3389/fenvs.2022.1039705

Khemir, S., Baccouche, C. E. M., & Ayadi, S. D. (2019). The influence of ESG information on investment allocation decisions. Journal of Applied Accounting Research, 20, 458–480. https://doi.org/10.1108/JAAR-12-2017-0141

Kulanov, A., Issakhova, A. S., Koshkina, O. V, Issakhova, P. B., & Karshalova, A. (2020). Venture Financing And The Fuel And Energy Complex: Investing In Alternative Energy. International Journal of Energy Economics and Policy, 10, 531–538. https://doi.org/10.32479/ijeep.9963

Lerman, L. V., Gerstlberger, W., Lima, M. F., & Frank, A. G. (2021). How governments, universities, and companies contribute to renewable energy development? A municipal innovation policy perspective of the triple helix. Energy Research and Social Science, 71, 101854. https://doi.org/10.1016/j.erss.2020.101854

Li, S., Yu, Y., Jahanger, A., Usman, M., & Ning, Y. (2022). The Impact of Green Investment, Technological Innovation, and Globalization on CO2 Emissions: Evidence From MINT Countries. Frontiers in Environmental Science, 10, 868704. https://doi.org/10.3389/fenvs.2022.868704

Li, X., & Yang, Y. (2022). Does Green Finance Contribute to Corporate Technological Innovation? The Moderating Role of Corporate Social Responsibility. Sustainability, 14(9), 5648. https://doi.org/10.3390/su14095648

Liberalesso, T., Cruz, C. O., Silva, C. M., & Manso, M. (2020). Green infrastructure and public policies: An international review of green roofs and green walls incentives. Land Use Policy, 96, 104693. https://doi.org/10.1016/j.landusepol.2020.104693

Lin, Z., Álvarez-Otero, S., ben Belgacem, S., & Fu, Q. (2022). Role of sustainable finance, geopolitical risk and economic growth in renewable energy investment: Empirical evidence from China. Geological Journal, 58, 3339–3347. https://doi.org/10.1002/gj.4654

Liu, B., & Giovanni, P. De. (2019). Green process innovation through Industry 4.0 technologies and supply chain coordination. Annals of Operations Research. https://doi.org/10.1007/s10479-019-03498-3

Liu, F. H. M., & Lai, K. P. Y. (2021). Ecologies of green finance: Green sukuk and development of green Islamic finance in Malaysia. Environment and Planning A: Economy and Space, 53, 1896–1914. https://doi.org/10.1177/0308518X211038349

Naeem, M. A., Nguyen, T. T. H., Nepal, R., Ngo, Q.-T., & Taghizadeh‐Hesary, F. (2021). Asymmetric relationship between green bonds and commodities: Evidence from extreme quantile approach. Finance Research Letters, 43(2), 101983. https://doi.org/10.1016/j.frl.2021.101983

ÓhAiseadha, C., Quinn, G., Connolly, R., Connolly, M., & Soon, W. W.-H. (2020). Energy and Climate Policy—An Evaluation of Global Climate Change Expenditure 2011–2018. Energies, 13(18), 4839. https://doi.org/10.3390/en13184839

Pirgaip, B., Arslan-Ayaydin, Ö., & Karan, M. B. (2020). Do Sukuk provide diversification benefits to conventional bond investors? Evidence from Turkey. Global Finance Journal, 50, 100533. https://doi.org/10.1016/j.gfj.2020.100533

Pizarro-Alonso, A., Ravn, H. F., & Münster, M. (2019). Uncertainties towards a fossil-free system with high integration of wind energy in long-term planning. Applied Energy, 253. https://doi.org/10.1016/j.apenergy.2019.113528

Polzin, F., Egli, F., Steffen, B., & Schmidt, T. S. (2019). How do policies mobilize private finance for renewable energy?—A systematic review with an investor perspective. Applied Energy, 236, 1249-1268. https://doi.org/10.1016/j.apenergy.2018.11.098

Pratiwi, S., & Juerges, N. (2020). Review of the impact of renewable energy development on the environment and nature conservation in Southeast Asia. Energy, Ecology and Environment, 5, 221–239. https://doi.org/10.1007/s40974-020-00166-2

Raeni, R., Thomson, I., & Frandsen, A.-C. (2022). Mobilising Islamic Funds for Climate Actions: From Transparency to Traceability. Social and Environmental Accountability Journal, 42, 38–62. https://doi.org/10.1080/0969160X.2022.2066553

Res-legal.eu. (2019). Germany: Overall Summary. Res-Legal.Eu. http://www.res-legal.eu/search-by-country/germany/#

Santoso, I. R. (2020). Green Sukuk and Sustainable Economic Development Goals: Mitigating Climate Change in Indonesia. Global Journal Al-Thaqafah, 10(1), 18-26. https://doi.org/10.7187/GJAT072020-3

Schmidt, T. S., Steffen, B., Egli, F., Pahle, M., Tietjen, O., & Edenhofer, O. (2019). Adverse effects of rising interest rates on sustainable energy transitions. Nature Sustainability, 2, 879–885. https://doi.org/10.1038/s41893-019-0375-2

Sdgs.bappenas.go.id. (2024). Era Baru Keuangan Berkelanjutan. Sdgs.Bappenas.Go.Id. https://sdgs.bappenas.go.id/era-baru-keuangan-berkelanjutan/

Shahbaz, M., Topcu, B. A., Sarigül, S. S., & Vo, X. V. (2021). The effect of financial development on renewable energy demand: The case of developing countries. Renewable Energy, 178, 1370–1380. https://doi.org/10.1016/j.renene.2021.06.121

Sohag, K., Chukavina, K., & Samargandi, N. (2021). Renewable energy and total factor productivity in OECD member countries. Journal of Cleaner Production, 296, 126499. https://doi.org/10.1016/j.jclepro.2021.126499

Stucki, T. (2019). Which firms benefit from investments in green energy technologies? – The effect of energy costs. Research Policy, 48(3), 546-555. https://doi.org/10.1016/j.respol.2018.09.010

Taghizadeh‐Hesary, F., & Yoshino, N. (2020). Sustainable Solutions for Green Financing and Investment in Renewable Energy Projects. Energies, 13(4), 788. https://doi.org/10.3390/en13040788

Tianotak, H. M., Sinaga, M., & Yaung, M. (2023). Kerja Sama Indonesia dan Denmark Dalam Pengembangan Energi Baru Terbarukan (EBT) Di Indonesia. Papua Journal of Diplomacy and International Relations, 3(1), 74–87. https://doi.org/10.31957/pjdir.v3i1.2649.

Tolliver, C., Keeley, A. R., & Managi, S. (2020). Policy targets behind green bonds for renewable energy: Do climate commitments matter? Technological Forecasting and Social Change, 157, 120051. https://doi.org/10.1016/j.techfore.2020.120051

Tseng, M., Tan, P. A., Jeng, S.-Y., Lin, C.-W. R., Negash, Y. T., & Darsono, S. N. A. C. (2019). Sustainable Investment: Interrelated among Corporate Governance, Economic Performance and Market Risks Using Investor Preference Approach. Sustainability, 11(7), 2108. https://doi.org/10.3390/su11072108

Wang, C., Li, X., Wen, H., & Nie, P. (2021). Order financing for promoting green transition. Journal of Cleaner Production, 283, 125415. https://doi.org/10.1016/j.jclepro.2020.125415

Xu, H., Mei, Q., Shahzad, F., Liu, S., Long, X., & Zhang, J. (2020). Untangling the Impact of Green Finance on the Enterprise Green Performance: A Meta-Analytic Approach. Sustainability, 12(21), 9085. https://doi.org/10.3390/su12219085

Yang, X., He, L., Xia, Y., & Chen, Y. (2019). Effect of government subsidies on renewable energy investments: The threshold effect. Energy Policy, 132, 156-166. https://doi.org/10.1016/j.enpol.2019.05.039

Zhang, S., Wu, Z., Wang, Y., & Hao, Y. (2021). Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. Journal of Environmental Management, 296, 113159. https://doi.org/10.1016/j.jenvman.2021.113159

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Iman Supriadi, Rahma Ulfa Maghfiroh, Rukhul Abadi

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.