Impact of Banking Fraud Awareness Booklet Among The Students of Satara

DOI:

https://doi.org/10.12928/mf.v5i2.7881Keywords:

Online Banking, Banking Frauds, Frauds, Awareness, BookletAbstract

With the growth of information and communication technology, the structure and nature of financial services delivery has also changed. Online banking or internet banking has emerged as a new and convenient way for using financial services like funds transfer, viewing account statement, bill payment, use of e-wallets etc. An upsurge in the use of devices connected with the internet and the convenience of online financial services has increased the risk of our hard-earned money being duped by cybercriminals.

The main aim of this study is to assess the impact of Banking fraud awareness Booklet regarding online among students of Satara.

The objectives of this study are to assess knowledge regarding awareness of online banking frauds among college going students, to determine the effectiveness of information booklet among college going students and also to find out association between socio-demographic variables and the booklet.

The results show the significant increase in mean scores as (mean pre 16.92 SD=2.591 to mean post 18.32 SD=1.842). The paired 't' test applied showed the calculated paired t value (5.291 at 0.05 level of significance). The study reveals that there is association between, class, department & course of the subjects and level of knowledge regarding awareness on online banking frauds.

The information booklet was effective in improving the knowledge of awareness regarding online banking frauds among the Undergraduate students.

Keywords: Online banking frauds, Banking fraud awareness booklet.

References

E. E. Alharasis, H. Haddad, M. Alhadab, M. Shehadeh, and E. F. Hasan, “Integrating forensic accounting in education and practices to detect and prevent fraud and misstatement: case study of Jordanian public sector,” JFRA, Aug. 2023, doi: 10.1108/JFRA-04-2023-0177.

M. Christinawati and H. Setiyawati, “Factors Affecting Banking Fraud Prevention and Their Impact On The Quality of Financial Statements,” IJSSB, vol. 6, no. 2, pp. 215–224, Jun. 2022, doi: 10.23887/ijssb.v6i2.46538.

C. Joseph, N. H. Omar, J. T. Janang, M. Rahmat, and N. Madi, “Development of the university fraud prevention disclosure index,” JFC, vol. 28, no. 3, pp. 883–891, Aug. 2021, doi: 10.1108/JFC-10-2019-0127.

A. D, “A Study of Consumer Awareness towards e-Banking,” Int J Econ Manag Sci, vol. 5, no. 4, 2016, doi: 10.4172/2162-6359.1000350.

D. K. J. Bhagat and P. M. Shinde, “A Study of Awareness of Banking Skills among The Degree Students in Mumbai City”.

A. Johri and S. Kumar, “Exploring Customer Awareness towards Their Cyber Security in the Kingdom of Saudi Arabia: A Study in the Era of Banking Digital Transformation,” Human Behavior and Emerging Technologies, vol. 2023, pp. 1–10, Jan. 2023, doi: 10.1155/2023/2103442.

A. Zaharia, “300+ Terrifying Cybercrime and Cybersecurity Statistics.” [Online]. Available: https://www.comparitech.com/vpn/cybersecurity-cyber-crime-statistics-facts-trends

C. Crime, “Cyber Crime Portal: Data 2021.” Cyber Crime Portal. [Online]. Available: https://cybercrime.gov.in

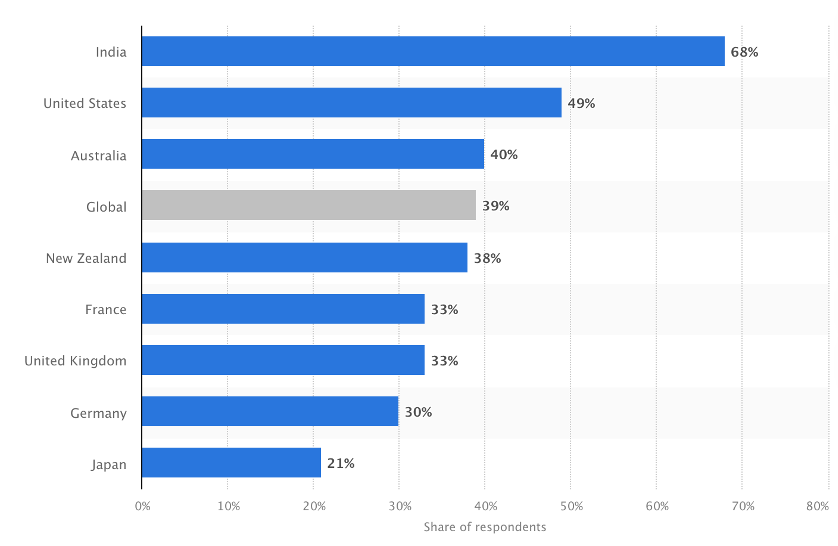

C. Statista, “Statista: Cyber Crime & Security - Percentage of internet users in selected countries who have ever experienced any cybercrime in 2022.” Statista Company. [Online]. Available: https://www.statista.com/statistics/194133/cybercrime-rate-in-selected-countries/

S. Poornima and R. Sridharan, “study on customer awareness and satisfaction towards e-banking services with special reference to Chennai City,” ijhs, pp. 10273–10279, May 2022, doi: 10.53730/ijhs.v6nS2.7749.

P. Datta, S. Tanwar, S. N. Panda, and A. Rana, “Security and Issues of M-Banking: A Technical Report,” in 2020 8th International Conference on Reliability, Infocom Technologies and Optimization (Trends and Future Directions) (ICRITO), Noida, India: IEEE, Jun. 2020, pp. 1115–1118. doi: 10.1109/ICRITO48877.2020.9198032.

P. Sood and P. Bhushan, “A structured review and theme analysis of financial frauds in the banking industry,” Asian J Bus Ethics, vol. 9, no. 2, pp. 305–321, Dec. 2020, doi: 10.1007/s13520-020-00111-w.

R. M. Aresta, E. W. Pratomo, V. Geraldino, A. Fauzi, and J. D. Santoso, “Malware Static Analysis on Microsoft Macro Attack,” mob.forensics.j, vol. 3, no. 1, pp. 17–25, Jul. 2021, doi: 10.12928/mf.v3i1.3764.

P. C. Andreou and D. Philip, “Financial Knowledge Among University Students and Implications for Personal Debt and Fraudulent Investments,” SSRN Journal, 2018, doi: 10.2139/ssrn.3250850.

Downloads

Published

Issue

Section

License

Copyright (c) 2023 Samidha Walvekar Samidha

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Start from 2019 issues, authors who publish with JURNAL MOBILE AND FORENSICS agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License (CC BY-SA 4.0) that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Mobile and Forensics (MF)

Mobile and Forensics (MF)