Digital Financial Transformation in Indonesia: Non-Cash Usage Via Modified UTAUT2 With Trust

DOI:

https://doi.org/10.12928/mf.v6i2.11709Keywords:

digital economy, UTAUT2, Behavioral Intention, Use Behavior, Structural Equation ModelingAbstract

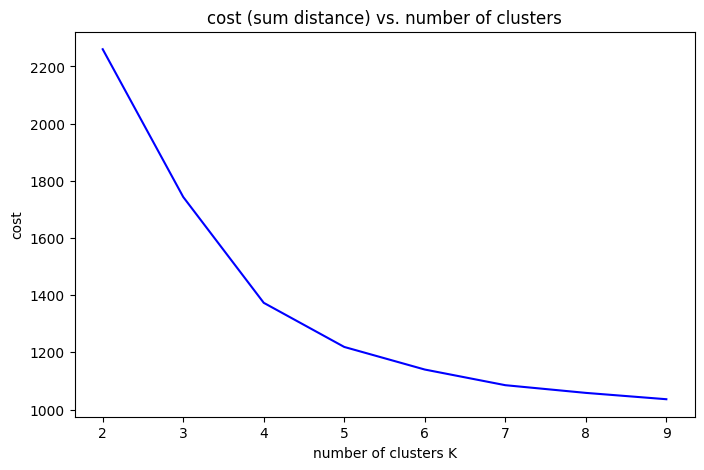

Digital payments are transforming the financial landscape in Indonesia, offering fast and efficient services that meet the growing demand for cashless transactions. This study analyzes the factors influencing digital payment adoption using the UTAUT2 model, with the addition of Trust as a critical factor. Cluster analysis was also conducted using the k-prototype algorithm to see their characteristics and perceptions about digital payments. A survey was conducted from June to August 2024, gathering 451 responses from users of digital payment services. The data were analyzed using structural equation modeling to test 13 hypotheses. Of these, 10 hypotheses were accepted, indicating that Effort Expectancy, Performance Expectancy, Social Influence, Facilitating Conditions, Hedonic Motivation, Habit, and Trust significantly influence Behavioral Intention. Social Influence and Facilitating Conditions also directly impacted trust, which further strengthened users' intention to adopt digital payments. However, Price Value did not significantly affect Behavioral Intention, and Habit was not a strong predictor of continued use behavior. Trust emerged as a key factor in driving user engagement and long-term adoption. The study highlights that while convenience and social influence are crucial, trust in digital payment services is essential for sustaining user adoption. Cluster analysis divides respondents into four clusters, where the first, second, and third clusters are from young people with different perceptions about digital payment and the fourth cluster is from mature people who are mostly working as teachers or lecturers. These findings offer valuable insights into promoting digital payment usage and supporting Indonesia’s shift towards a digital economy.

References

E. D. Paramita and E. R. Cahyadi, “The Determinants of Behavioral Intention and Use Behavior of QRIS as Digital Payment Method Using Extended UTAUT Model,” Indones. J. Bus. Entrep., 2024, doi: 10.17358/ijbe.10.1.132.

D. Ha, A. Şensoy, and A. Phung, “Empowering mobile money users: The role of financial literacy and trust in Vietnam,” Borsa Istanbul Rev., vol. 23, no. 6, pp. 1367–1379, 2023, doi: 10.1016/j.bir.2023.10.009.

D. T. Sasongko, P. W. Handayani, and R. Satria, “Analysis of factors affecting continuance use intention of the electronic money application in Indonesia,” Procedia Comput. Sci., vol. 197, no. 2021, pp. 42–50, 2022, doi: 10.1016/j.procs.2021.12.116.

A. Gunawan, A. F. Fatikasari, and S. A. Putri, “The Effect of Using Cashless (QRIS) on Daily Payment Transactions Using the Technology Acceptance Model,” Procedia Comput. Sci., vol. 227, pp. 548–556, 2023, doi: 10.1016/j.procs.2023.10.557.

I. E. Letters, “Evaluation of factors affecting intention to use qris payment transaction,” ICIC Int., vol. 16, no. 4, pp. 343–349, 2022, doi: 10.24507/icicel.16.04.343.

A. Kadim and N. Sunardi, “Financial Management System (QRIS) based on UTAUT Model Approach in Jabodetabek,” Int. J. Artif. Intell. Res., vol. 6, no. 1, 2021, doi: 10.29099/ijair.v6i1.282.

M. Yasin, “Kisah Pembatasan Transaksi Tunai Dalam hukum Indonesia,” Hukum Online, 2015. [Online]. Available: https://www.hukumonline.com/berita/a/kisah-pembatasan-transaksi- tunai-dalam-hukum-indonesia-lt55c526243b295/. [Accessed: 15-Feb-2024].

I. K. Abdul-hamid, A. A. Shaikh, H. Boateng, and R. E. Hinson, “Customers ’ Perceived Risk and Trust in Using Mobile Money Services — an Empirical Study of Ghana,” Int. J. E-bus. Res., vol. 15, no. 1, pp. 1–19, 2019, doi: 10.4018/IJEBR.2019010101.

I. T. P. Putra and I. Heruwasto, “Factors Affecting Consumer Intention To Use Qris During The Covid-19 Pandemic By USING C-TAM-TPB,” 2022.

S. D. Ermawan and S. Raharja, “Analysis Of The Influence Of Digital Payment Systems On Banking Efficiency In Indonesia,” Int. J. Educ. Bus. Econ. Res., vol. 2, no. 1, pp. 34–52, 2022.

Bank Indonesia, “Menavigasi Sistem Pembayaran Nasional di Era Digital. Available on Blueprint Sistem Pembayaran Indonesia 2025,” Bank Indonesia, 2019. [Online]. Available: https://www.bi.go.id/id/fungsi-utama/sistem-pembayaran/blueprint-2025/default.aspx. [Accessed: 14-Feb-2024].

H. Sulistyaningsih and D. Hanggraeni, “Investigating the Adoption of QR Code Indonesian Standard through Organizational and Environmental Factors and Its Impact on Micro Small Medium Enterprise Performance,” Glob. Bus. Manag. Res. suppl. Spec. Issue, vol. 14, no. 3s, pp. 962–982, 2022.

A. Muditomo and N. Setyawati, “Digital Transformation of Small Medium Enterprises: A Descriptive Analysis of Quick Response Indonesia Standard Data,” Jambura Equilib. J., vol. 4, no. 2, pp. 49–57, 2022.

H. Sulistyaningsih and D. Hanggraeni, “The Impact of Technological, Organisational, Environmental Factors on The Adoption of QR Code Indonesian Standard and Micro Small Medium Enterprise Performance,” Turkish J. Comput. Math. Educ., vol. 12, no. 14, pp. 5325–5341, 2021.

A. A. Puspitasari and I. Salehudin, “Quick Response Indonesian Standard (QRIS): Does Government Support Contribute to Cashless Payment System Long-term Adoption?,” J. Mark. Innov., vol. 2, no. 1, pp. 27–42, 2022, doi: 10.35313/jmi.v2i1.29.

N. A. Sinulingga, “Medan City Msme Digital Payment Ecosystem Using Quick Response Code Indonesian Standard,” J. Manajemen, Inform. …, vol. 1, no. 2, pp. 119–123, 2022.

P. Sartini, I. P. D. Yudharta, and P. E. Purnamaningsih, “Efektivitas Program SIAP (Sehat, Inovatif, Aman, Pakai) Quick Response Code Indonesian Standard (QRIS) untuk Mendukung Inklusi Keuangan Digital di Pasar Badung, Kota Denpasar,” Bus. Invest. Rev., vol. 1, no. 3, pp. 195–210, 2023, doi: 10.61292/birev.v1i3.29.

D. T. Anggarini, “Application of Quick Response Code Indonesian as a Payment Tool in Digitizing MSMEs,” Sentralisasi, vol. 11, no. 1, pp. 1–14, 2022, doi: 10.33506/sl.v11i1.1504.

D. Q. Nada, S. Suryaningsum, and H. K. S. Negara, “Digitalization of the Quick Response Indonesian Standard (QRIS) Payment System for MSME Development,” J. Int. Conf. Proc., vol. 4, no. 3, pp. 551–558, 2021, doi: 10.32535/jicp.v4i3.1358.

E. Susanto, I. Solikin, and B. S. Purnomo, “a Review of Digital Payment Adoption in Asia,” Adv. Int. J. Business, Entrep. SMEs, vol. 4, no. 11, pp. 01–15, 2022, doi: 10.35631/aijbes.411001.

M. R. N. A. Hendrawan, S. A. Marits, and S. Herman, “Development of Digital Payment Systems in Indonesia,” J. Ilm. Manaj. Kesatuan, vol. 11, no. 3, pp. 1335–1344, 2023.

N. Luh, P. Tary Wulandari, and G. S. Darma, “Gede Sri Darma.Textile Industry Issue in Pandemic of Covid-19-Palarch’s,” J. Archaeol. Egypt/Egyptology, vol. 17, no. 7, pp. 8064–8074, 2020.

M. M. Hakim, A. N. Afifah, and G. Aryotejo, “The Analysis of Factors Affecting Behavioral Intention and Behavior Usage of E-Wallet Using Meta-UTAUT Model.,” Int. J. Adv. Sci. Eng. Inf. Technol., vol. 13, no. 2, p. 786, 2023, doi: 10.18517/ijaseit.13.2.18297.

N. Dzakiyyah, “UTAUT Model Analysis on E-Wallet Usage of Vocational School Students UTAUT Model Analysis on E-Wallet Usage of Vocational School Students Literature Review And Hypotheses Development,” vol. 11, no. 2, pp. 86–98, 2023.

N. C. Hussin, H. Ahmad, R. Ali, M. Zakaria, U. Teknologi, and M. Cawangan, “Adopting Unified Theory Acceptance and Use of Technology ( UTAUT ) in Predicting Accounting Student Intention to Use E-Wallet,” vol. 6, no. 1, pp. 156–163, 2023.

F. Liébana-Cabanillas, Z. Kalinic, F. Muñoz-Leiva, and E. Higueras-Castillo, “Biometric m-payment systems: A multi-analytical approach to determining use intention,” Inf. Manag., vol. 61, no. 2, 2024, doi: 10.1016/j.im.2023.103907.

S. S. Chand and B. A. Kumar, “Applying the UTAUT Model to Understand M-payment Adoption. A Case Study of Western Part of Fiji,” J. Knowl. Econ., no. February, 2024, doi: 10.1007/s13132-023-01722-x.

D. Sharma and Y. K. Vaid, “Factors Affecting M-Payment Adoption in Millenials – Testing Extended Utaut2 Model,” Thail. World Econ., vol. 41, no. 2, pp. 40–61, 2023.

M. K. Hunde, A. W. Demsash, and A. D. Walle, “Behavioral intention to use e-learning and its associated factors among health science students in Mettu university, southwest Ethiopia: Using modified UTAUT model,” Informatics Med. Unlocked, vol. 36, 2023.

K. Putera KOSIM and N. Legowo, “Factors Affecting Consumer Intention on QR Payment of Mobile Banking: A Case Study in Indonesia,” J. Asian Financ., vol. 8, no. 5, pp. 391–0401, 2021, doi: 10.13106/jafeb.2021.vol8.no5.0391.

D. I. Saibil, F. Sodik2, and A. A. Mardiah, “Factors Affecting the Intention of Using Qris in Sharia Mobile Banking,” J u r n a l N i s b a h, vol. 8, pp. 76–92, 2022.

H. Patil and S. Undale, “Willingness of university students to continue using e-Learning platforms after compelled adoption of technology: Test of an extended UTAUT model,” Educ. Inf. Technol., vol. 28, no. 11, pp. 14943–14965, 2023, doi: 10.1007/s10639-023-11778-6.

R. Awad, A. Aljaafreh, and A. Salameh, “Factors Affecting Students’ Continued Usage Intention of E-Learning During COVID-19 Pandemic: Extending Delone & Mclean IS Success Model,” Int. J. Emerg. Technol. Learn., vol. 17, no. 10, pp. 120–144, 2022, doi: 10.3991/ijet.v17i10.30545.

K. Tabianan, S. Velu, and V. Ravi, “K-Means Clustering Approach for Intelligent Customer Segmentation Using Customer Purchase Behavior Data,” Sustain., vol. 14, no. 12, pp. 1–15, 2022, doi: 10.3390/su14127243.

M. G. Pradana and H. T. Ha, “Maximizing Strategy Improvement in Mall Customer Segmentation using K-means Clustering,” J. Appl. Data Sci., vol. 2, no. 1, pp. 19–25, 2021, doi: 10.47738/jads.v2i1.18.

R. Madhuri, M. R. Murty, J. V. R. Murthy, P. V. G. D. P. Reddy, and S. C. Satapathy, “Cluster Analysis on Different Data Sets Using K-Modes and K-Prototype Algorithms,” Adv. Intell. Syst. Comput., vol. 249 VOLUME II, no. December 2013, pp. 137–144, 2014, doi: 10.1007/978-3-319-03095-1_15.

B. Kim, “A fast K-prototypes algorithm using partial distance computation,” Symmetry (Basel)., vol. 9, no. 4, 2017, doi: 10.3390/sym9040058.

H. Hernández, E. Alberdi, A. Goti, and A. Oyarbide-Zubillaga, “Application of the k-Prototype Clustering Approach for the Definition of Geostatistical Estimation Domains,” Mathematics, vol. 11, no. 3, pp. 1–17, 2023, doi: 10.3390/math11030740.

V. Venkatesh, M. G. Morris, G. B. Davis, and F. D. Davis, “User Acceptance of Information Technology: Toward a Unified View,” MIS Q., vol. 27, no. 3, pp. 425–478, Jul. 2003, doi: 10.2307/30036540.

V. Venkatesh, J. Y. L. Thong, and X. Xu, “Consumer Acceptance and Use of Information Technology: Extending the Unified Theory of Acceptance and Use of Technology,” MIS Q., vol. 36, no. 1, pp. 157–178, Jul. 2012, doi: 10.2307/41410412.

A. A. H. Zaid Kilani, D. F. Kakeesh, G. A. Al-Weshah, and M. M. Al-Debei, “Consumer post-adoption of e-wallet: An extended UTAUT2 perspective with trust,” J. Open Innov. Technol. Mark. Complex., vol. 9, no. 3, p. 100113, 2023, doi: 10.1016/j.joitmc.2023.100113.

E. K. Penney, J. Agyei, E. K. Boadi, E. Abrokwah, and R. Ofori-Boafo, “Understanding Factors That Influence Consumer Intention to Use Mobile Money Services: An Application of UTAUT2 With Perceived Risk and Trust,” SAGE Open, vol. 11, no. 3, 2021, doi: 10.1177/21582440211023188.

M. A. Idrees and S. Ullah, “Comparative analysis of FinTech adoption among Islamic and conventional banking users with moderating effect of education level: A UTAUT2 perspective,” J. Open Innov. Technol. Mark. Complex., vol. 10, no. 3, p. 100343, 2024, doi: https://doi.org/10.1016/j.joitmc.2024.100343.

M. Merhi, K. Hone, and A. Tarhini, “A cross-cultural study of the intention to use mobile banking between Lebanese and British consumers: Extending UTAUT2 with security, privacy and trust,” Technol. Soc., vol. 59, p. 101151, 2019, doi: https://doi.org/10.1016/j.techsoc.2019.101151.

O. Ogbanufe and D. Kim, “Comparing fingerprint-based biometrics authentication versus traditional authentication methods for e-payment,” Decis. Support Syst., vol. 106, Nov. 2017, doi: 10.1016/j.dss.2017.11.003.

M. Alhwaiti, “Acceptance of Artificial Intelligence Application in the Post-Covid Era and Its Impact on Faculty Members’ Occupational Well-being and Teaching Self Efficacy: A Path Analysis Using the UTAUT 2 Model,” Appl. Artif. Intell., vol. 37, no. 1, p. 2175110, Dec. 2023, doi: 10.1080/08839514.2023.2175110.

A. F. Alkhwaldi and A. S. A. Eshoush, “Towards A model for Citizens’ Acceptance of E-Payment Systems for Public Sector Services in Jordan: Evidence from Crisis Era,” Inf. Sci. Lett., vol. 11, no. 3, pp. 657–663, 2022, doi: 10.18576/isl/110302.

A. Rabaa’i, “An Investigation into the acceptance of mobile wallets in the FinTech era: an empirical study from Kuwait,” J. Bus. Inf. Syst., p. 1, Jan. 2022, doi: 10.1504/IJBIS.2021.10038422.

G. Migliore, R. Wagner, F. S. Cechella, and F. Liébana-Cabanillas, “Antecedents to the Adoption of Mobile Payment in China and Italy: an Integration of UTAUT2 and Innovation Resistance Theory,” Inf. Syst. Front., vol. 24, no. 6, pp. 2099–2122, 2022, doi: 10.1007/s10796-021-10237-2.

W.-J. Suo, C.-L. Goi, M. Goi, and A. Sim, “Factors Influencing Behavioural Intention to Adopt the QR-Code Payment: Extending UTAUT2 Model,” Int. J. Asian Bus. Inf. Manag., vol. 13, pp. 1–22, Jan. 2022, doi: 10.4018/IJABIM.20220701.oa8.

P. Baudier, G. Kondrateva, and C. Ammi, “The future of Telemedicine Cabin? The case of the French students’ acceptability,” Futures, vol. 122, no. June, p. 102595, 2020, doi: 10.1016/j.futures.2020.102595.

B. M. Martinez and L. E. McAndrews, “Investigating U.S. consumers’ mobile pay through UTAUT2 and generational cohort theory: An analysis of mobile pay in pandemic times,” Telemat. Informatics Reports, vol. 11, p. 100076, 2023, doi: https://doi.org/10.1016/j.teler.2023.100076.

S. A. Nuswantoro, M. Ulfi, Miftahurrizqi, and M. Rafli, “Identification of Factors Influencing the Use of QRIS Using TAM and UTAUT 2 Methods,” Sci. J. Informatics, vol. 11, no. 2, pp. 451–466, 2024, doi: 10.15294/sji.v11i2.3562.

A. R. A. G. Hameed and P. Bin Sumari, “Adoption and continued usage of mobile learning of virtual platforms in Iraqi higher education an unstable environment,” Int. J. Inf. Manag. Data Insights, vol. 4, no. 2, p. 100242, 2024, doi: 10.1016/j.jjimei.2024.100242.

A. A. Alalwan, Y. K. Dwivedi, N. P. P. Rana, and M. D. Williams, “Consumer adoption of mobile banking in Jordan,” J. Enterp. Inf. Manag., vol. 29, no. 1, pp. 118–139, Jan. 2016, doi: 10.1108/JEIM-04-2015-0035.

S. Nordhoff et al., “Using the UTAUT2 model to explain public acceptance of conditionally automated (L3) cars: A questionnaire study among 9,118 car drivers from eight European countries,” Transp. Res. Part F Traffic Psychol. Behav., vol. 74, pp. 280–297, 2020, doi: 10.1016/j.trf.2020.07.015.

M. F. Wei, Y. H. Luh, Y. H. Huang, and Y. C. Chang, “Young generation’s mobile payment adoption behavior: Analysis based on an extended utaut model,” J. Theor. Appl. Electron. Commer. Res., vol. 16, no. 4, pp. 618–637, 2021, doi: 10.3390/jtaer16040037.

R. Z. Wu, J. H. Lee, and X. F. Tian, “Determinants of the intention to use cross-border mobile payments in korea among chinese tourists: An integrated perspective of utaut2 with ttf and itm,” J. Theor. Appl. Electron. Commer. Res., vol. 16, no. 5, pp. 1537–1556, 2021, doi: 10.3390/jtaer16050086.

M. G. de B. Sebastian, A. Antonovica, and J. R. S. Guede, “What are the leading factors for using Spanish peer-to-peer mobile payment platform Bizum? The applied analysis of the UTAUT2 model,” Technol. Forecast. Soc. Change, vol. 187, no. June 2022, 2023, doi: 10.1016/j.techfore.2022.122235.

F. Yang, L. Ren, and C. Gu, “A study of college students’ intention to use metaverse technology for basketball learning based on UTAUT2,” Heliyon, vol. 8, no. 9, p. e10562, 2022, doi: 10.1016/j.heliyon.2022.e10562.

P. Ramírez-Correa, F. J. Rondán-Cataluña, J. Arenas-Gaitán, and F. Martín-Velicia, “Analysing the acceptation of online games in mobile devices: An application of UTAUT2,” J. Retail. Consum. Serv., vol. 50, pp. 85–93, 2019, doi: https://doi.org/10.1016/j.jretconser.2019.04.018.

C. Tam, D. Santos, and T. Oliveira, “Exploring the influential factors of continuance intention to use mobile Apps: Extending the expectation confirmation model,” Inf. Syst. Front., vol. 22, Feb. 2020, doi: 10.1007/s10796-018-9864-5.

S. Talwar, A. Dhir, A. Khalil, G. Mohan, and A. K. M. N. Islam, “Point of adoption and beyond. Initial trust and mobile-payment continuation intention,” J. Retail. Consum. Serv., vol. 55, p. 102086, 2020, doi: https://doi.org/10.1016/j.jretconser.2020.102086.

W. Alkhowaiter, “Use and behavioural intention of m-payment in GCC countries: Extending meta-UTAUT with trust and Islamic religiosity,” J. Innov. Knowl., vol. 7, p. 100240, Oct. 2022, doi: 10.1016/j.jik.2022.100240.

M. Alfarizi and R. Kurnia, “Adoption Of Cash on Delivery (COD) Payment System in Shopee Marketplace Transaction,” Procedia Comput. Sci., vol. 227, pp. 110–118, Jan. 2023, doi: 10.1016/j.procs.2023.10.508.

N. Singh and N. Sinha, “How perceived trust mediates merchant’s intention to use a mobile wallet technology,” J. Retail. Consum. Serv., vol. 52, no. June 2019, p. 101894, 2020, doi: 10.1016/j.jretconser.2019.101894.

M. J. Gumasing et al., “Using Online Grocery Applications during the COVID-19 Pandemic: Their Relationship with Open Innovation,” J. Open Innov. Technol. Mark. Complex., vol. 8, p. 93, May 2022, doi: 10.3390/joitmc8020093.

J. Hair, G. T. M. Hult, C. Ringle, and M. Sarstedt, A Primer on Partial Least Squares Structural Equation Modeling. Los Angeles: SAGE Publications, 2014.

R. de S. Abrahão, S. N. Moriguchi, and D. F. Andrade, “Intention of adoption of mobile payment: An analysis in the light of the Unified Theory of Acceptance and Use of Technology (UTAUT),” RAI Rev. Adm. e Inovação, vol. 13, no. 3, pp. 221–230, 2016, doi: https://doi.org/10.1016/j.rai.2016.06.003.

W. R. Lin, C. Y. Lin, and Y. H. Ding, “Factors affecting the behavioral intention to adopt mobile payment: An empirical study in Taiwan,” Mathematics, vol. 8, no. 10, pp. 1–19, 2020, doi: 10.3390/math8101851.

S. Chresentia and Y. Suharto, “Assessing Consumer Adoption Model on E-Wallet: an Extended Utaut2 Approach,” Int. J. Econ. Bus. Manag. Res., vol. 4, no. 06, pp. 232–244, 2020.

K. Namahoot and V. Jantasri, “Integration of UTAUT model in Thailand cashless payment system adoption: the mediating role of perceived risk and trust,” J. Sci. Technol. Policy Manag., vol. 14, Feb. 2022, doi: 10.1108/JSTPM-07-2020-0102.

T. Fatima, S. Kashif, M. Kamran, and T. Mumtaz Awan, “Examining Factors Influencing Adoption of M-Payment: Extending UTAUT2 with Perceived Value,” Int. J. Innov. Creat. Chang. www.ijicc.net, vol. 15, no. 8, p. 2021, 2021.

A. Susilowatia, B. Riantob, N. Wijayac, and L. Sanny, “Effects of UTAUT 2 Model on the Use of BCA Mobile Banking in Indonesia,” Turkish J. Comput. Math. Educ., vol. 12, no. 3, pp. 5378–5387, 2021, doi: 10.17762/turcomat.v12i3.2183.

N. B. Do and H. N. T. Do, “An investigation of Generation Z’s Intention to use Electronic Wallet in Vietnam,” J. Distrib. Sci., vol. 18, no. 10, pp. 89–99, 2020, doi: 10.15722/jds.18.10.202010.89.

P. K. Senyo and E. Osabutey, “Unearthing antecedents to financial inclusion through FinTech innovations,” Technovation, vol. 98, Jun. 2020, doi: 10.1016/j.technovation.2020.102155.

N. Luh and W. Novianti, “Minat Penggunaan E-Wallet Dengan Model Utaut2 Pada Mahasiswa Akuntansi Di Bali,” vol. 5, no. 1, pp. 266–278, 2024.

Aarts and A. Henk Dijksterhuis P, “The Automatic Activation Of Goal-Directed Behaviour: The Case Of Travel Habit,” J. Environ. Psychol., vol. 20, no. 1, pp. 75–82, 2000, doi: https://doi.org/10.1006/jevp.1999.0156.

A. T. To and T. H. M. Trinh, “Understanding behavioral intention to use mobile wallets in vietnam: Extending the tam model with trust and enjoyment,” Cogent Bus. Manag., vol. 8, no. 1, p. 1891661, Jan. 2021, doi: 10.1080/23311975.2021.1891661.

R. Chan, I. Troshani, S. Rao Hill, and A. Hoffmann, “Towards an understanding of consumers’ FinTech adoption: the case of Open Banking,” Int. J. Bank Mark., vol. 40, Apr. 2022, doi: 10.1108/IJBM-08-2021-0397.

Downloads

Published

Issue

Section

License

Copyright (c) 2024 Setio Ardy Nuswantoro, Muhammad Ulfi, Sahwari Sahwari, Linda Linda, Amara Damayanti

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Start from 2019 issues, authors who publish with JURNAL MOBILE AND FORENSICS agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License (CC BY-SA 4.0) that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Mobile and Forensics (MF)

Mobile and Forensics (MF)