Predicting financial distress in Indonesian life insurance companies with classification methods and synthetic features generation

DOI:

https://doi.org/10.12928/bamme.v5i1.13114Keywords:

Extreme Gradient Boosting, financial distress, life insurance, Synthetic Features GenerationAbstract

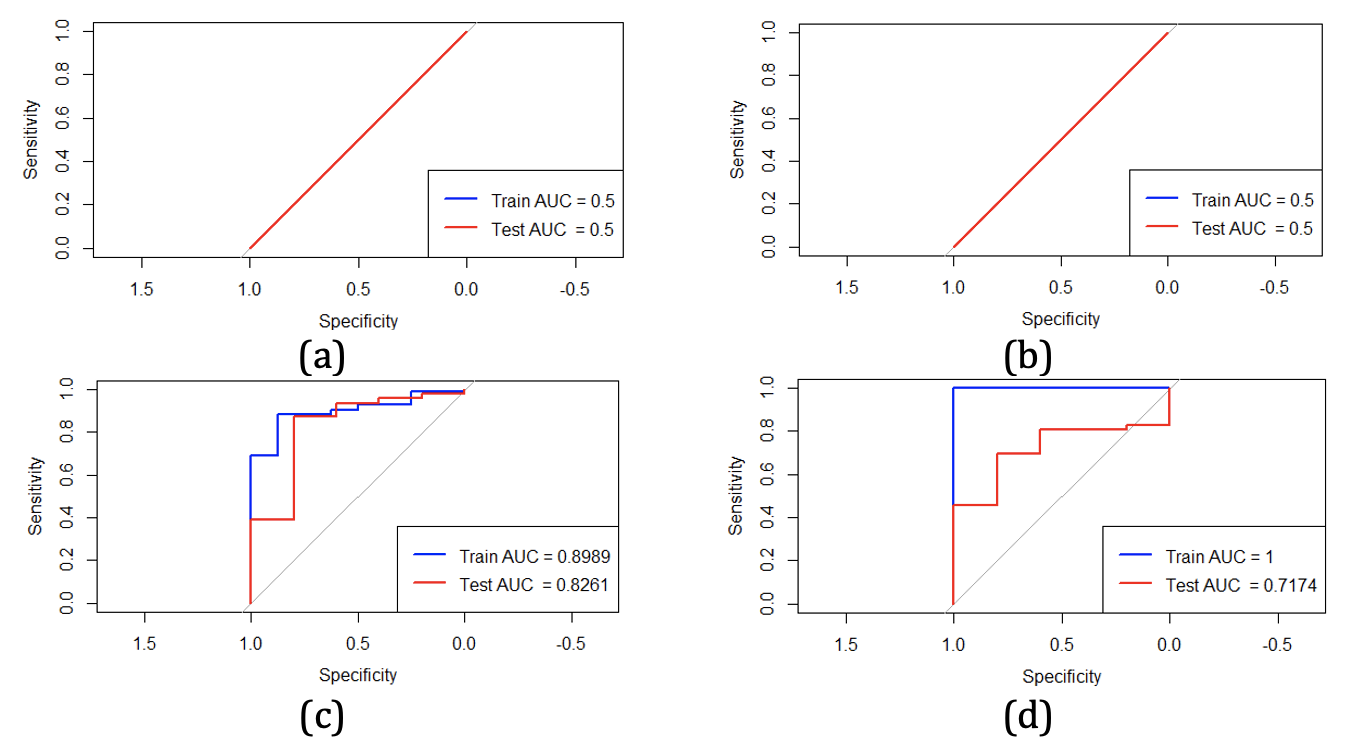

Financial problems in life insurance companies can become serious if not addressed immediately. Companies experiencing financial distress, for instance, are unable to meet their obligations to pay their liabilities. A company can be categorized as experiencing financial distress when it has an RBC ratio of less than 120%—based on regulation by the Indonesian Finance Service Authority—or ROA < 0 (suffering loss). Therefore, financial distress prediction is carried out to assess the company's current financial condition so that it can be handled early. In this study, we aimed to predict financial distress of Indonesian life insurance companies. We utilized the Support Vector Machine (SVM) classification method, Generalized Extreme Value Regression (GEVR), and Extreme Gradient Boosting (XGB) and by incorporating synthetic feature generation in variable selection. The results of financial distress prediction obtained the best model that can predict the financial condition of life insurance companies in Indonesia at each size, where for sizes 0 and 1, the XGB model with variable selection produces accuracy values of 98.00% and 94.10%, respectively, and AUC values of 100% and 87.40%. Then, at size 2, we can use Stepwise Generalized Extreme Value Regression with accuracy and AUC results of 90.20% and 82.60%, respectively. Each addition of size to the time window classification results tends to reduce the model's performance in predicting the financial condition of life insurance companies in Indonesia.

References

Ariesta, D. R., & Chariri, A. (2013). Analisis pengaruh struktur dewan komisaris, struktur kepemilikan saham dan komite audit terhadap financial distress. Diponegoro Journal of Accounting, 1(1), 1-9.

Azhar, H., & Hidayat, N. (2021). Penegakan Hukum yang Mengganggu Roda Ekonomi Kasus Jiwasraya dan Dampaknya terhadap Pasar Modal Indonesia. Lokataru Foundation.

Calabrese, R., & Osmetti, S. A. (2011). Generalized extreme value regression for binary rare events data: an application to credit defaults. Bulletin of the International Statistical Institute LXII, 58th Session of the International Statistical Institute, 5631-5634.

Calabrese, R., & Osmetti, S. A. (2013). Modelling small and medium enterprise loan defaults as rare events: the generalized extreme value regression model. Journal of Applied Statistics, 40(6), 1172–1188. https://doi.org/10.1080/02664763.2013.784894

Chen, T., & Guestrin, C. (2016). XGBoost. Proceedings of the 22nd ACM SIGKDD International Conference on Knowledge Discovery and Data Mining, 785–794. https://doi.org/10.1145/2939672.2939785

Cortes, C., & Vapnik, V. (1995). Support-vector networks. Machine Learning, 20(3), 273–297. https://doi.org/10.1007/BF00994018

Dewi, M. R., & Purnami, S. W. (2015). Klasifikasi hasil pap smear test sebagai upaya pencegahan sekunder penyakit kanker serviks di rumah sakit “X” Surabaya menggunakan Piecewise Polynomial Smooth Support Vector Machine (PPSSVM). Jurnal Sains dan Seni ITS, 4(1), D61-D66.

Hardle, W., Prastyo, D. D., & Hafner, C. (2014). Support vector machines with evolutionary model selection for default prediction. In J. Racine, L. Su, & A. Ullah, The Oxford Handbook of Applied Nonparametric and Semiparametric Econometrics and Statistics. Oxford University Press.

Hotho, A., Nürnberger, A., & Paaß, G. (2005). A brief survey of text mining. Journal for Language Technology and Computational Linguistics, 20(1), 19-62.

Johnson, R., & Wichern, D. (2007). Applied Multivariate Statistical Analysis Sixth Edition (6th ed.). Pearson Education, Inc.

Kordestani, M., Saif, M., Orchard, M. E., Razavi-Far, R., & Khorasani, K. (2021). Failure Prognosis and Applications—A Survey of Recent Literature. IEEE Transactions on Reliability, 70(2), 728–748. https://doi.org/10.1109/TR.2019.2930195

Li, Q. (2019). Logistic and SVM Credit Score Models Based on Lasso Variable Selection. Journal of Applied Mathematics and Physics, 07(05), 1131–1148.

Mo, H., Sun, H., Liu, J., & Wei, S. (2019). Developing window behavior models for residential buildings using the XGBoost algorithm. Energy and Buildings, 205, 109564. https://doi.org/10.1016/j.enbuild.2019.109564

OJK. (2023). Asuransi. Otoritas Jasa Keuangan.

Osman, A. I. A., Najah Ahmed, A. N., Chow, M. F., Huang, Y. F., & El-Shafie, A. (2021). Extreme gradient boosting (Xgboost) model to predict the groundwater levels in Selangor Malaysia. Ain Shams Engineering Journal, 12(2), 1545–1556. https://doi.org/10.1016/j.asej.2020.11.011

Platt, H. D., & Platt, M. B. (2002). Predicting corporate financial distress: Reflections on choice-based sample bias. Journal of Economics and Finance, 26(2), 184–199. https://doi.org/10.1007/BF02755985

Putri, R. N., Djuraidah, A., & Rahman, L. O. A. (2011). Analisis Ukuran Risiko Keuangan Menggunakan Teori Nilai Ekstrim : Studi Kasus Indeks Harga Saham Gabungan Periode 2001-2010. IPB University. http://repository.ipb.ac.id/handle/123456789/51709

Qasthari, E. T. (2017). Teknik Pengukuran: Metode Klasifikasi Support Vector Machine (SVM) pada Data Pengukuran. Universitas Indonesia.

Ramadhani, S. W. (2022). Prediksi financial distress perusahaan asuransi jiwa di indonesia dengan metode support vector machine, generalized extreme value regression, dan logistic regression. Thesis. Institut Teknologi Sepuluh November.

Scholz, M., & Klinkenberg, R. (2007). Boosting classifiers for drifting concepts. Intelligent Data Analysis, 11(1), 3–28. https://doi.org/10.3233/IDA-2007-11102

Zięba, M., Tomczak, S. K., & Tomczak, J. M. (2016). Ensemble boosted trees with synthetic features generation in application to bankruptcy prediction. Expert Systems with Applications, 58, 93–101. https://doi.org/10.1016/j.eswa.2016.04.001

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Dwi Purwanto, Dedy Dwi Prastyo

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under Creative Commons Attribution License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).