Relationship between opening and closing of stock prices for IHSG and issuers: A case study in the Indonesia Stock Exchange

DOI:

https://doi.org/10.12928/bamme.v5i1.12975Keywords:

closing price, IHSG, investor, irrational behavior, issuersAbstract

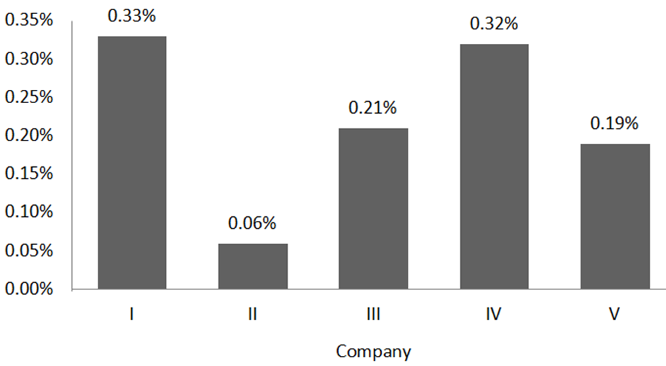

Identifying the most influential variables in stock price movements is a crucial aspect of developing an accurate mathematical model for predicting market trends. This study analyzes two main variables: the composite stock price index (IHSG) and the closing price of company shares, to determine the extent of their influence on stock prices on the observation day. The findings indicate that the IHSG from one day prior to the observation day does not have a significant impact on the closing price of a particular stock. This means that changes in the IHSG on the previous day cannot be used as the main indicator to predict a company's stock price on the following day. On the other hand, the closing price of a company's stock on the previous day has a strong correlation with the company's closing stock price on the observation day, which is 70%. Besides historical stock price factors, irrational investor behavior can cause volatility that does not fully reflect a stock’s fundamental value. Therefore, it is essential to consider investors' psychological aspects in stock market analysis.

References

Ahmed, B. (2020). Understanding the impact of investor sentiment on the price formation process: A review of the conduct of American stock markets. The Journal of Economic Asymmetries, 22, e00172. https://doi.org/10.1016/j.jeca.2020.e00172

Bouteska, A., Sharif, T., & Abedin, M. Z. (2024). Does investor sentiment create value for asset pricing? An empirical investigation of the KOSPI‐listed firms. International Journal of Finance & Economics, 29(3), 3487-3509. https://doi.org/10.1002/ijfe.2836

Cheng, F., Chiao, C., Fang, Z., Wang, C., & Yao, S. (2020). Raising short-term debt for long-term investment and stock price crash risk: Evidence from China. Finance Research Letters, 33, 101200. https://doi.org/10.1016/j.frl.2019.05.018

Cho, T., & Polk, C. (2024). Putting the price in asset pricing. The Journal of Finance, 79(6), 3943-3984. https://doi.org/10.1111/jofi.13391

Chun, D., Cho, H., & Ryu, D. (2020). Economic indicators and stock market volatility in an emerging economy. Economic Systems, 44(2), 100788. https://doi.org/10.1016/j.ecosys.2020.100788

Fuad, F., & Yuliadi, I. (2021). Determinants of the Composite Stock Price Index (IHSG) on the Indonesia Stock Exchange. Journal of Economics Research and Social Sciences, 5(1), 27-41. https://doi.org/10.18196/jerss.v5i1.11002

Gong, X., Zhang, W., Wang, J., & Wang, C. (2022). Investor sentiment and stock volatility: New evidence. International Review of Financial Analysis, 80, 102028. https://doi.org/10.1016/j.irfa.2022.102028

Grant, J. (1999). A Handbook of Economic Indicators. University of Toronto Press.

Kumar, G., Jain, S., & Singh, U. P. (2021). Stock market forecasting using computational intelligence: A survey. Archives of computational methods in engineering, 28(3), 1069-1101. https://doi.org/10.1007/s11831-020-09413-5

Li, X., Wu, P., & Wang, W. (2020). Incorporating stock prices and news sentiments for stock market prediction: A case of Hong Kong. Information Processing & Management, 57(5), 102212. https://doi.org/10.1016/j.ipm.2020.102212

Liu, Q., Lee, W. S., Huang, M., & Wu, Q. (2023). Synergy between stock prices and investor sentiment in social media. Borsa Istanbul Review, 23(1), 76-92. https://doi.org/10.1016/j.bir.2022.09.006

Mikrad, M., Budi, A., & Febrianto, H. G. (2023). Comparative analysis of the performance of the Composite Stock Price Index (IHSG) with the Indonesian Sharia Stock Index (ISSI) during the Covid-19 pandemic. International Journal of Management Science and Information Technology, 3(1), 93-100. https://doi.org/10.35870/ijmsit.v3i1.1107

Reis, P. M. N., & Pinho, C. (2021). A reappraisal of the causal relationship between sentiment proxies and stock returns. Journal of Behavioral Finance, 22(4), 420-442. https://doi.org/10.1080/15427560.2020.1792910

Sunaryo, D. (2020). The effect of net profit margin, return on asset, return on equity on share prices in The Southeast Asian metal industry. International Journal of Science, Technology & Management, 1(3), 198-208. https://doi.org/10.46729/ijstm.v1i3.47

Tedeschi, L. O. (2006). Assessment of the adequacy of mathematical models. Agricultural systems, 89(2-3), 225-247. https://doi.org/10.1016/j.agsy.2005.11.004

Walpole, R. E., Myers, R. H., Myers, S. L., & Ye, K. (1993). Probability and Statistics for Engineers and Scientists. Macmillan.

Yao, C. Z., & Li, H. Y. (2020). Time-varying lead–lag structure between investor sentiment and stock market. The North American Journal of Economics and Finance, 52, 101148. https://doi.org/10.1016/j.najef.2020.101148

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Efron Manik

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under Creative Commons Attribution License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).